For the 24 hours to 23:00 GMT, the USD rose 0.16% against the CHF and closed at 1.0285.

On the data front, trade surplus in Switzerland widened more-than-expected to CHF 3.64 billion in November, following a revised trade surplus of CHF 2.66 billion in the previous month, while markets were anticipating the nation to post a surplus of CHF 3.56 billion. On the other hand, the nation’s exports dropped 0.4% on a monthly basis in November, hitting its lowest level since September 2015 and compared to a revised decline of 6.7% in the prior month. Further, the nation’s imports fell 4.2% MoM in November, after recording a revised rise of 2.6% in the previous month.

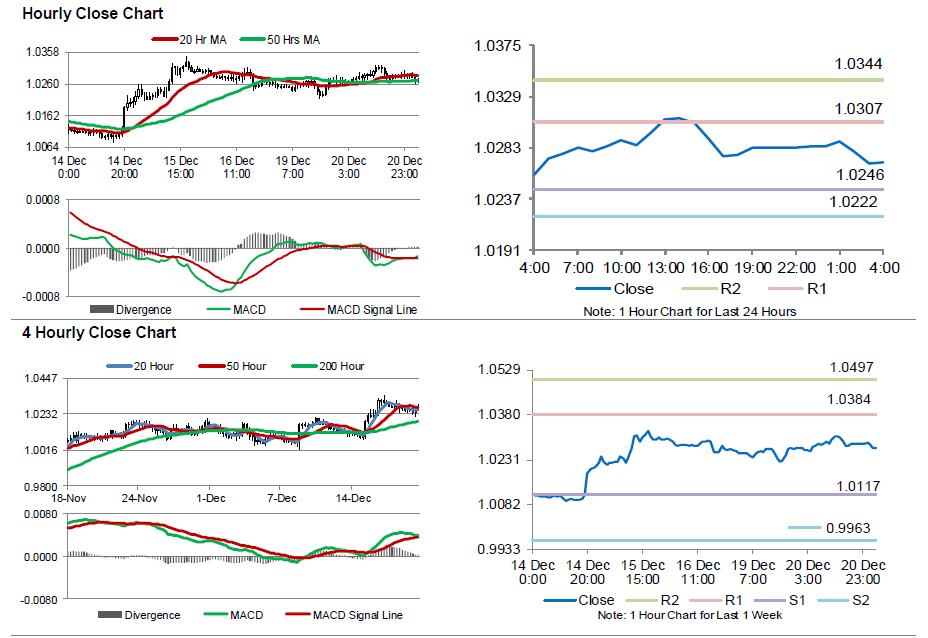

In the Asian session, at GMT0400, the pair is trading at 1.027, with the USD trading 0.15% lower against the CHF from yesterday’s close.

The pair is expected to find support at 1.0246, and a fall through could take it to the next support level of 1.0222. The pair is expected to find its first resistance at 1.0307, and a rise through could take it to the next resistance level of 1.0344.

Looking ahead, Swiss National Bank’s (SNB) quarterly bulletin report, due to release in a few hours, will garner significant amount of market attention.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.