For the 24 hours to 23:00 GMT, the USD rose 0.39% against the CHF and closed at 0.9684.

On the macro front, Switzerland’s seasonally adjusted unemployment rate surprisingly remained steady at a level of 3.2% in May, while market participants were expecting unemployment rate to climb to 3.3%. Moreover, the nation’s consumer price index rose by 0.2% in May. The CPI had advanced 0.2% in the previous month.

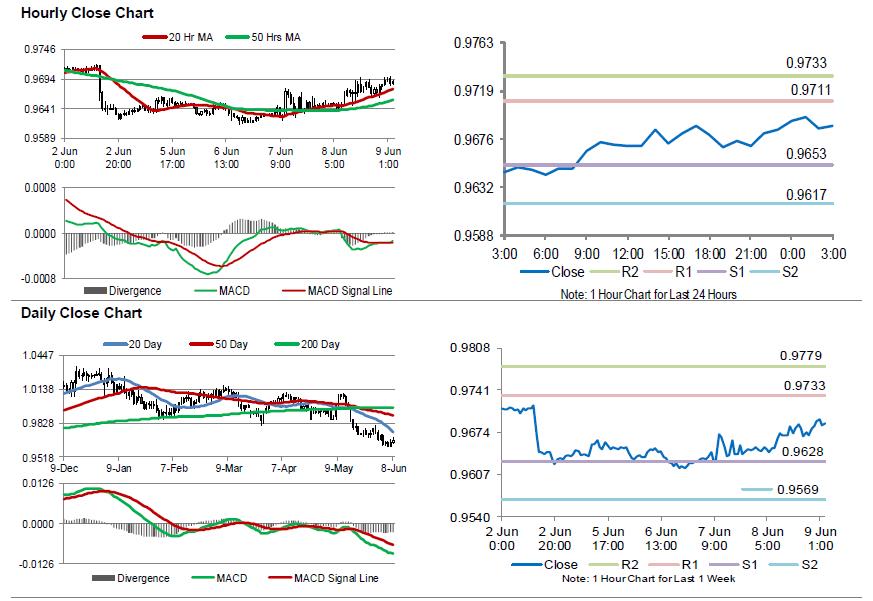

In the Asian session, at GMT0300, the pair is trading at 0.9688, with the USD trading a tad higher against the CHF from yesterday’s close.

The pair is expected to find support at 0.9653, and a fall through could take it to the next support level of 0.9617. The pair is expected to find its first resistance at 0.9711, and a rise through could take it to the next resistance level of 0.9733.

Next week, traders would focus on the Swiss National Bank’s (SNB) interest rate decision.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.