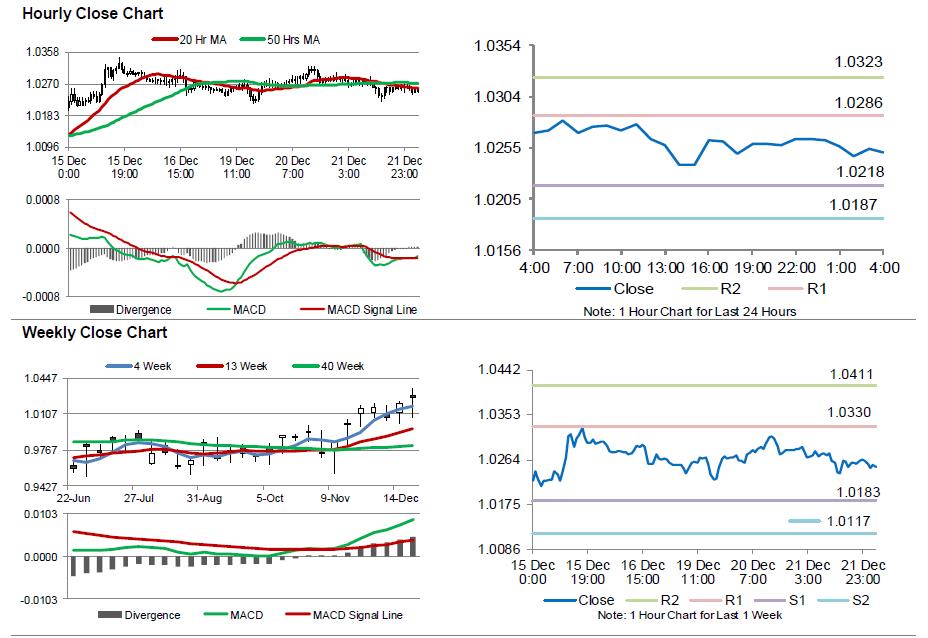

For the 24 hours to 23:00 GMT, the USD declined 0.2% against the CHF and closed at 1.0264.

According to the Swiss National Bank’s (SNB) quarterly bulletin report, the Swiss economy is likely to recover further in the coming quarters, as positive incoming economic data are pointing towards a brighter picture of the economic growth in the near term. Nonetheless, the SNB has confirmed that it will stick to its monetary course outlined at its monetary policy assessment in mid-September.

In the Asian session, at GMT0400, the pair is trading at 1.0250, with the USD trading 0.14% lower against the CHF from yesterday’s close.

The pair is expected to find support at 1.0218, and a fall through could take it to the next support level of 1.0187. The pair is expected to find its first resistance at 1.0286, and a rise through could take it to the next resistance level of 1.0323.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.