For the 24 hours to 23:00 GMT, the USD declined 0.79% against the CHF and closed at 0.9824 on Friday.

In economic news, Switzerland’s consumer price index fell 0.5% on a monthly basis in July, more than market expectations for a drop of 0.4% and compared to a flat reading in the previous month. Moreover, the nation’s manufacturing PMI contracted to a level of 44.7 in July, marking its lowest level since July 2009 and compared to a level of 47.7 in the preceding month. Market participants had indicated a drop to a level of 47.5.

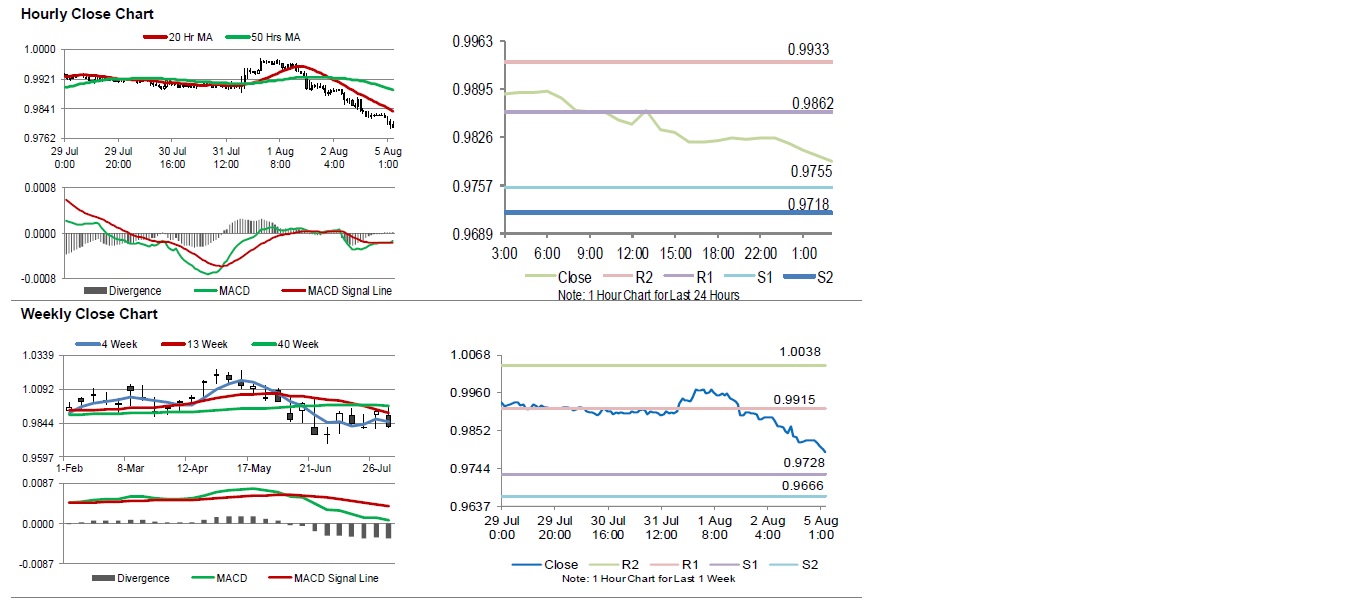

In the Asian session, at GMT0300, the pair is trading at 0.9791, with the USD trading 0.33% lower against the CHF from Friday’s close.

The pair is expected to find support at 0.9755, and a fall through could take it to the next support level of 0.9718. The pair is expected to find its first resistance at 0.9862, and a rise through could take it to the next resistance level of 0.9933.

Looking ahead, investors would await Switzerland’s real retail sales for June and the SECO consumer confidence index for July, set to release in a while.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.