For the 24 hours to 23:00 GMT, the USD rose 0.68% against the CHF and closed at 0.9894. The Swiss Franc lost ground, after Switzerland’s SECO downgraded the nation’s GDP growth forecast to 0.9% in 2015, compared to 2.1% expansion estimated earlier and also remained downbeat regarding the country’s economic growth in 2016, due to the strength of Swiss Franc, thus worsening the outlook for the nation’s economy.

Separately, the SNB decided to keep its deposit rate at -0.75%, in line with market expectations and left the target rate for three-month Libor unchanged at between -1.25% and -0.25%. Meanwhile, data showed that Switzerland’s trade surplus narrowed to CHF2.47 billion, from prior month’s surplus of CHF3.41 billion.

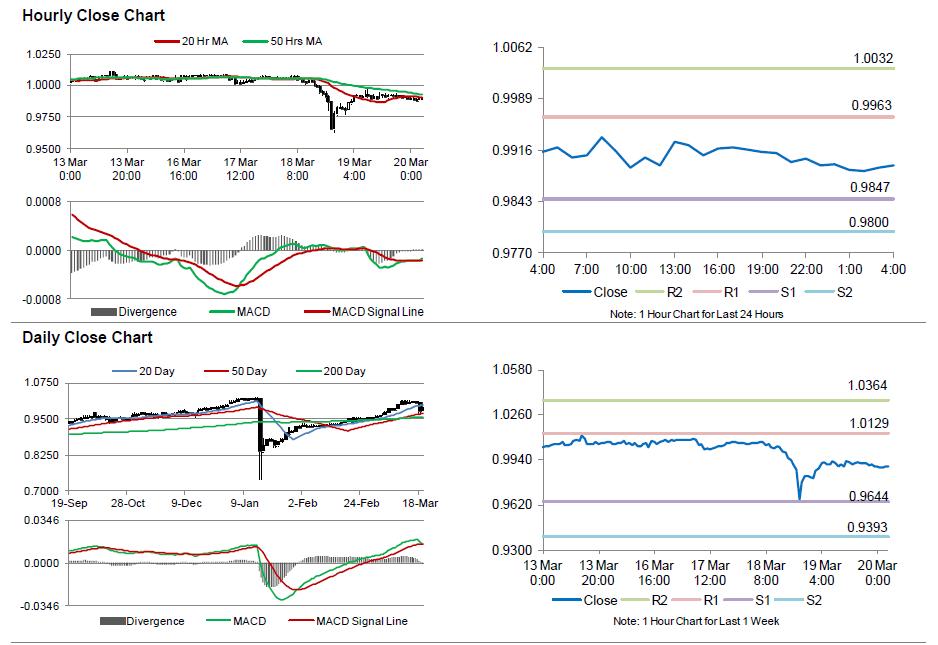

In the Asian session, at GMT0400, the pair is trading at 0.9894, with the USD trading flat from yesterday’s close.

The pair is expected to find support at 0.9847, and a fall through could take it to the next support level of 0.98. The pair is expected to find its first resistance at 0.9963, and a rise through could take it to the next resistance level of 1.0032.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.