For the 24 hours to 23:00 GMT, the USD declined 0.16% against the CHF and closed at 0.9714.

The Swiss National Bank, in its recent monetary policy meeting, held its key interest rate unchanged at record low level of -0.75%, in line with market expectations. The central bank shrugged off criticism of ultra-loose monetary policy and currency intervention while stating that it is intended to make Swiss Franc investments less attractive. In a statement issued post the meeting, the central bank stated that it would continue to be active in the foreign exchange market, as necessary and also noted that the domestic currency is still significantly overvalued. Further, the SNB kept its inflation forecast unchanged at -0.4% for this year, but lowered its inflation outlook to 0.2% and 0.6% for 2017 and 2018, respectively.

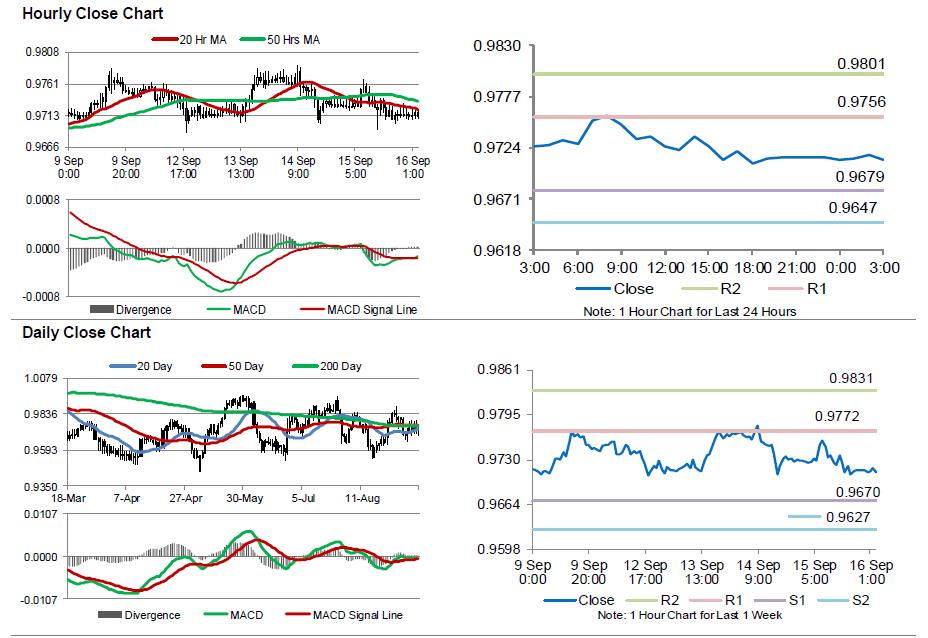

In the Asian session, at GMT0300, the pair is trading at 0.9712, with the USD trading marginally lower against the CHF from yesterday’s close.

The pair is expected to find support at 0.9679, and a fall through could take it to the next support level of 0.9647. The pair is expected to find its first resistance at 0.9756, and a rise through could take it to the next resistance level of 0.9801.

Moving ahead, investors would focus on Switzerland’s SECO economic forecasts, trade balance and SNB’s 3Q quarterly bulletin report, all slated to release next week.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.