For the 24 hours to 23:00 GMT, the USD declined 0.10% against the CHF and closed at 0.9209.

Yesterday, the SNB maintained its deposit rate at a record low of -0.75%, as widely expected and reiterated that the central bank was prepared to take further action to reduce the strength of the Swiss Franc which is already significantly “over-valued”.

In other economic news, Switzerland’s trade surplus widened more than expected to CHF3.43 billion, up from previous month’s revised surplus of CHF2.66 billion.

In the Asian session, at GMT0300, the pair is trading at 0.9207, with the USD trading a tad lower from yesterday’s close.

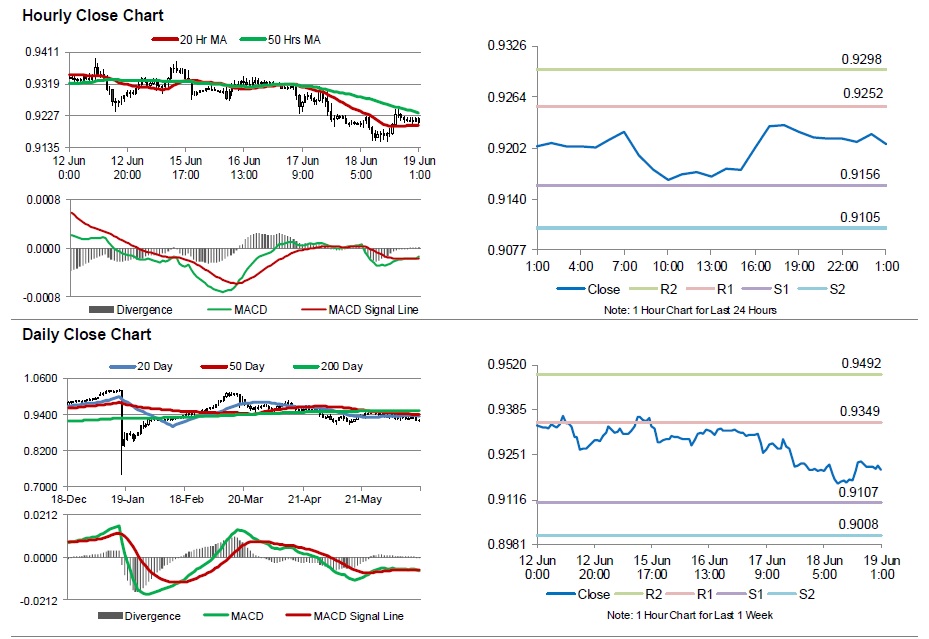

The pair is expected to find support at 0.9156, and a fall through could take it to the next support level of 0.9105. The pair is expected to find its first resistance at 0.9252, and a rise through could take it to the next resistance level of 0.9298.

Moving ahead, market participants would keep a close eye on Switzerland’s UBS consumption indicator data, scheduled next week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.