For the 24 hours to 23:00 GMT, the USD declined 16.16% against the CHF and closed at 0.8541. The Swiss Franc traded on a stronger footing after the SNB in a surprise move removed its cap of 1.20 per Euro, which it had introduced in September 2011 and also lowered its deposit interest rate to -0.75% on sight deposit account balances.

In the Asian session, at GMT0400, the pair is trading at 0.8645, with the USD trading 1.23% higher from yesterday’s close.

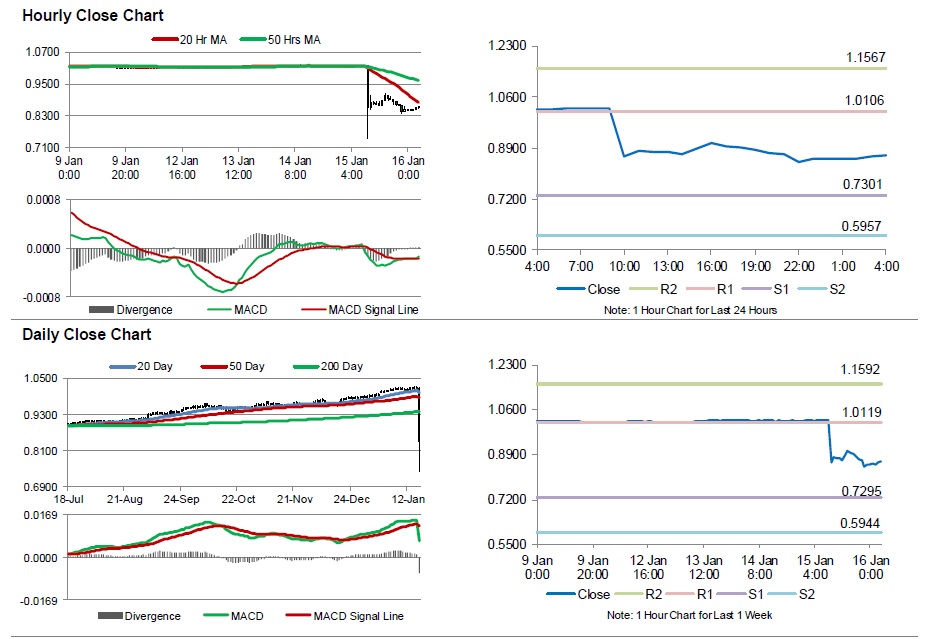

The pair is expected to find support at 0.7301, and a fall through could take it to the next support level of 0.5957. The pair is expected to find its first resistance at 1.0106, and a rise through could take it to the next resistance level of 1.1567.

Going forward, market participants await Switzerland’s real retail sales data for further cues, scheduled in few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.