On Friday, the USD strengthened 0.13% against the JPY and closed at 120.40.

The JPY continued its downward trend after poor macro-economic data from Japan cast doubts on the economic health of the nation. Data released last week indicated that Japan’s annual core consumer inflation decelerated for a fourth consecutive month in November, thus showing waning prospects of the central bank meeting its inflation target in the near future. Additionally, data showed that industrial output dropped unexpectedly, while household spending remained weak during November.

Other data showed that the vehicle production in Japan fell 12.20% on an annual basis in November, as compared to a 6.30% drop registered in the previous month.

On Saturday, the Japan’s government approved stimulus spending worth $29 billion, which the government forecasts would help Japan’s economic growth to increase by 0.7%.

In the Asian session, at GMT0400, the pair is trading at 120.46, with the USD trading 0.05% higher from Friday’s close.

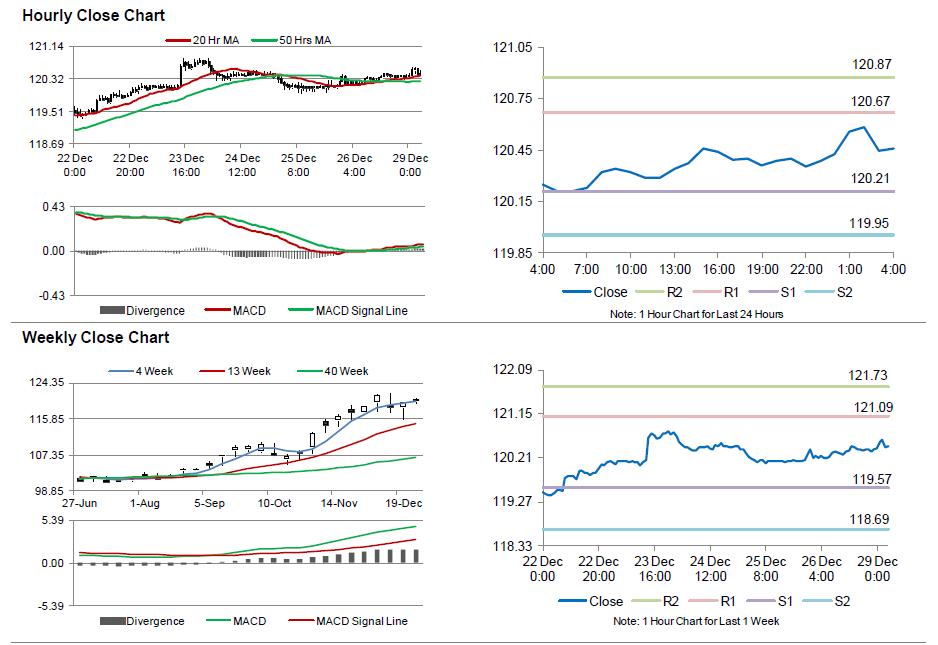

The pair is expected to find support at 120.21, and a fall through could take it to the next support level of 119.95. The pair is expected to find its first resistance at 120.67, and a rise through could take it to the next resistance level of 120.87.

Trading trends in the pair today are expected to be determined by global news as the Japanese market would be closed mostly during the week on account of New Year.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.