For the 24 hours to 23:00 GMT, the USD declined 0.68% against the JPY and closed at 117.06.

In the Asian session, at GMT0400, the pair is trading at 117.20, with the USD trading 0.12% higher against the JPY from yesterday’s close.

The Japanese Yen weakened against the USD, after the Bank of Japan (BoJ), in a widely expected move, opted to keep the key interest rate unchanged at -0.1% and maintained target for monetary base expansion at an annual pace of around ¥80.0 trillion. In a post meeting statement, the BoJ struck a more upbeat tone on the nation’s economic outlook, noting that “exports have picked up” and that Japan’s economy has continued its “moderate recovery trend”. However, inflation expectations remain weak and risks to the outlook on a higher side, ranging from developments in the Chinese and US economies to Brexit and geopolitical uncertainties.

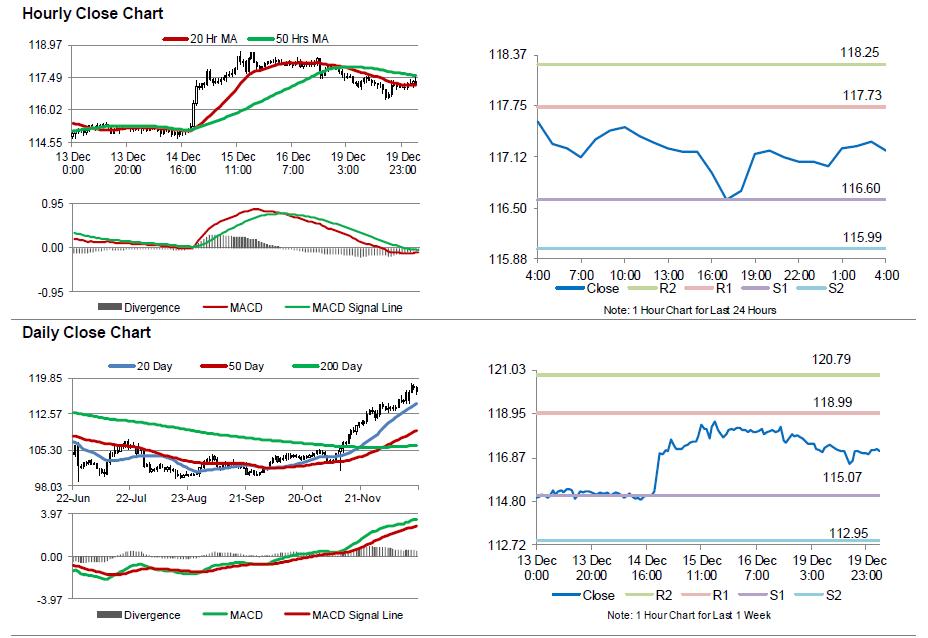

The pair is expected to find support at 116.60, and a fall through could take it to the next support level of 115.99. The pair is expected to find its first resistance at 117.73, and a rise through could take it to the next resistance level of 118.25.

Looking ahead, Japan’s all industry activity index for October, scheduled to release overnight, would pique investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.