For the 24 hours to 23:00 GMT, the USD rose 0.15% against the JPY and closed at 118.80.

In the Asian session, at GMT0400, the pair is trading at 120.08, with the USD trading 1.08% higher from yesterday’s close.

Early this morning, the BoJ unexpectedly cut the interest rate down to -0.1%. After the meeting, the BoJ stated that the decision was taken amid concerns on slowing global growth, tumbling oil prices and turmoil in Chinese economy. It also added that the central bank will cut interest rates further if the situation demands for it.

Overnight data showed that Japan’s national consumer price index rose by 0.2% YoY in December, at par with market expectations and after recording a rise of 0.3% in the preceding month. Meanwhile, the nation’s unemployment rate remained steady at 3.3% in December, in line with market expectations. Further, the nation’s flash industrial production index fell more than expected by 1.4% MoM in December, compared to market expectations of a fall of 0.3%, and following a drop of 0.9% in the preceding month.

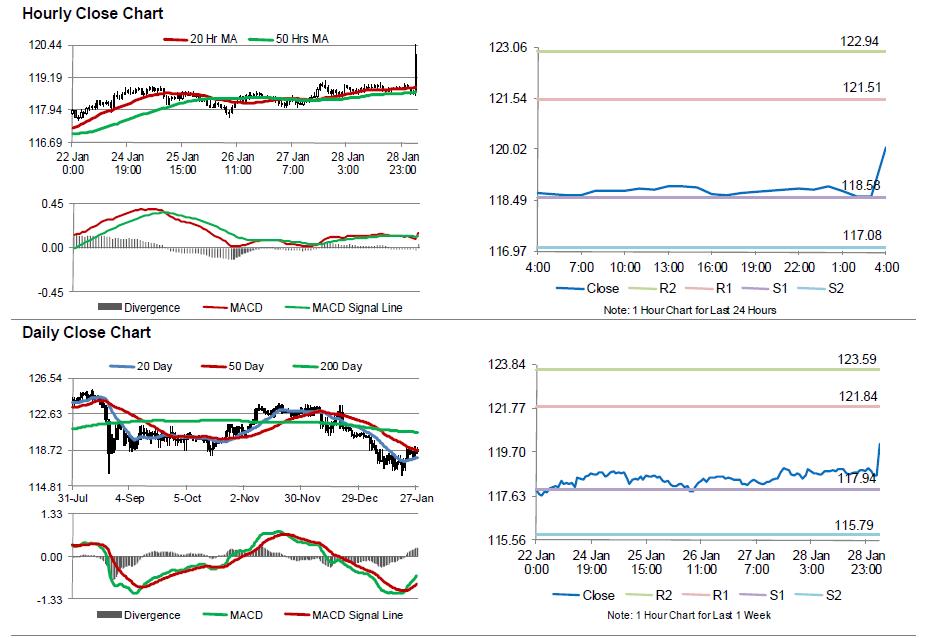

The pair is expected to find support at 118.58, and a fall through could take it to the next support level of 117.08. The pair is expected to find its first resistance at 121.51, and a rise through could take it to the next resistance level of 122.94.

Moving ahead, investors will look forward to Japan’s construction orders and housing starts data, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.