For the 24 hours to 23:00 GMT, the USD rose 0.16% against the JPY and closed at 110.95.

In the Asian session, at GMT0400, the pair is trading at 110.77, with the USD trading 0.16% lower against the JPY from yesterday’s close.

The Japanese Yen gained ground against the USD, after the Bank of Japan (BoJ), at its January monetary policy meeting, opted to leave the key interest rate steady at -0.1% and held the yield target for 10-year Japanese government bonds around 0%. In its quarterly economic outlook report, the central bank stuck to its view that inflation in Japan will likely achieve its 2.0% target in the 2019 fiscal year.

Earlier today, data showed that Japan’s all industry activity index climbed more-than-expected by 1.0% MoM in November, compared to an advance of 0.3% in the prior month. Market anticipation was for the activity index to climb 0.8%.

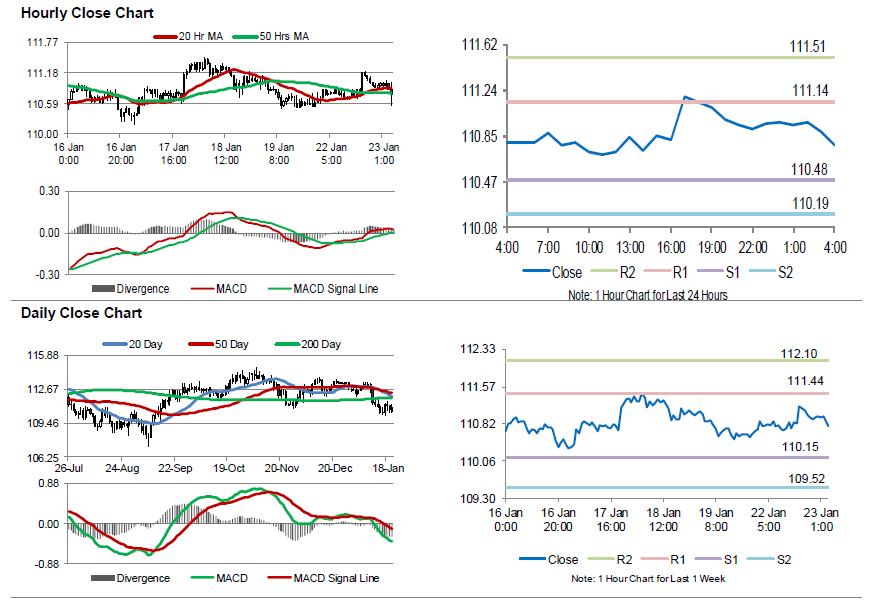

The pair is expected to find support at 110.48, and a fall through could take it to the next support level of 110.19. The pair is expected to find its first resistance at 111.14, and a rise through could take it to the next resistance level of 111.51.

Looking forward, traders would keep a close watch on Japan’s flash Nikkei manufacturing PMI for January and adjusted merchandise trade balance for December, due to release overnight.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.