For the 24 hours to 23:00 GMT, the USD marginally weakened against the JPY and closed at 102.40.

In a speech to the Japan Chamber of Commerce and Industry, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda stated that he sees a high probability for the consumer inflation rate in Japan to reach the central bank’s target sometime from the end of fiscal 2014 to the beginning of fiscal 2015. He further highlighted that upward pressure on consumer prices would climb, helped by improvements in the supply demand balance, but the positive impact from energy prices would start to fade.

In economic news, convenience store sales in Japan rose 1.0% (YoY) in February, following a 0.1% drop in the previous month.

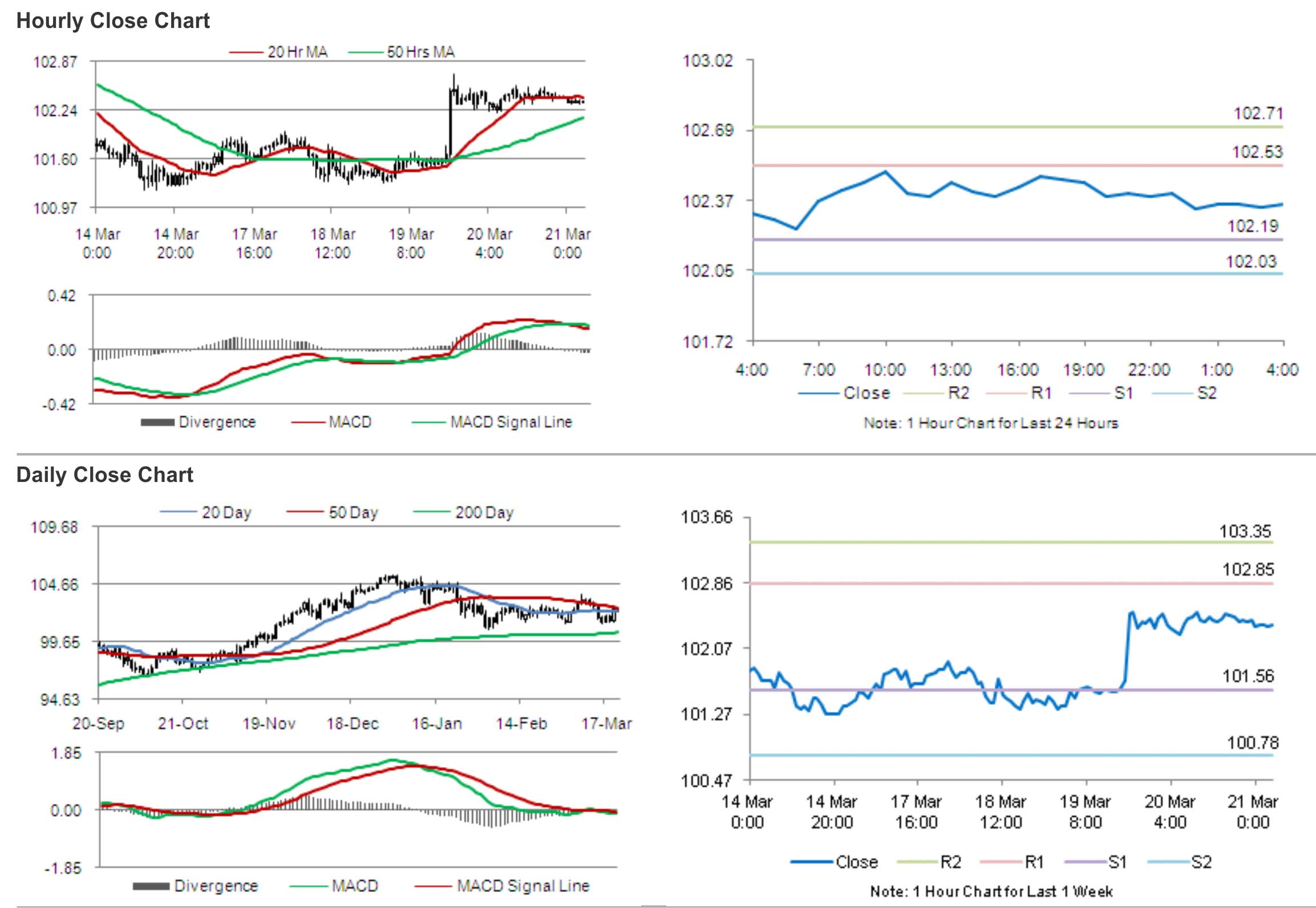

In the Asian session, at GMT0400, the pair is trading at 102.35, with the USD trading slightly lower from yesterday’s close.

The pair is expected to find support at 102.19, and a fall through could take it to the next support level of 102.03. The pair is expected to find its first resistance at 102.53, and a rise through could take it to the next resistance level of 102.71.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.