For the 24 hours to 23:00 GMT, the USD declined 0.45% against the JPY and closed at 110.04.

In the Asian session, at GMT0300, the pair is trading at 110.07, with the USD trading slightly higher against the JPY from yesterday’s close.

The minutes of the Bank of Japan (BoJ) April monetary policy showed that the BoJ’s reflationist Goushi Katoka was against the view of other policymakers to keep monetary policy unchanged and suggested that further easing was required to accelerate inflation. Moreover, members indicated that it was appropriate to drop the timeframe the bank had set for achieving its 2.0% inflation target. Further, most of the officials shared the view that the country’s economic expansion was progressing as expected and is likely to continue.

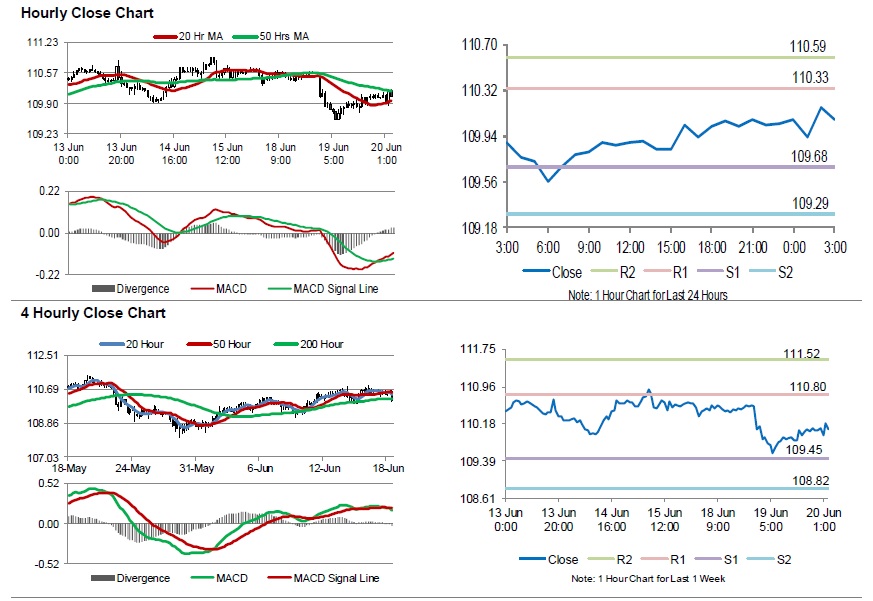

The pair is expected to find support at 109.68, and a fall through could take it to the next support level of 109.29. The pair is expected to find its first resistance at 110.33, and a rise through could take it to the next resistance level of 110.59.

In absence of key economic releases in Japan today, investor sentiment would be determined by global macroeconomic events.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.