For the 24 hours to 23:00 GMT, the USD rose 0.06% against the JPY and closed at 114.12 on Friday.

Minutes of the Bank of Japan’s (BoJ) September policy meeting, which were released overnight, revealed that Japan’s economy continued to proceed at an acceptable pace. However, the policy members cited downside risks to growth amid uncertainty in US economic policies and Brexit outcome. Also, most of the board members believed that the BoJ’s current policy was adequate to achieve 2.0% inflation in the long term.

In other news, Japan’s services PMI climbed to more than two-year high of 53.4 in October due to a sharp increase in new orders, from a reading of 51.0 recorded in the previous month.

In the Asian session, at GMT0400, the pair is trading at 114.34, with the USD trading 0.19% higher from Friday’s close.

Earlier this morning, the BoJ Governor, Haruhiko Kuroda, expressed his confidence in Japan’s economy by stating that the nation’s economic growth is gathering momentum and there is a growing possibility of inflation hitting the 2.0% target, thus strengthening expectations that no additional stimulus is forthcoming. He also stated that there is no need to alter the pace of its ETF purchases under its stimulus programme for the time being.

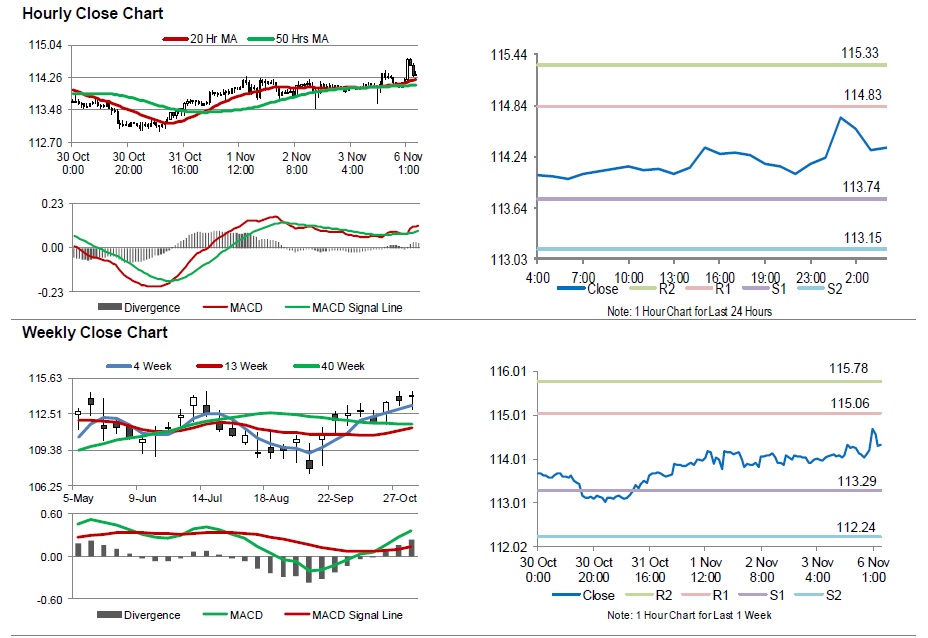

The pair is expected to find support at 113.74, and a fall through could take it to the next support level of 113.15. The pair is expected to find its first resistance at 114.83, and a rise through could take it to the next resistance level of 115.33.

With no additional economic release in Japan today, traders will look forward to global macroeconomic data for further direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.