For the 24 hours to 23:00 GMT, the USD strengthened 0.11% against the JPY and closed at 123.57.

In the Asian session, at GMT0400, the pair is trading at 123.19, with the USD trading 0.31% lower from yesterday’s close.

Overnight data showed that Japan surprisingly recorded a merchandise trade surplus of ¥111.5 billion in October, from a revised trade deficit of ¥115.8 billion in the previous month. Market expectation was for a trade deficit of ¥246.3 billion.

On an annual basis, imports in Japan dropped more-than-expected by 13.4% in October, compared to a revised fall of 11.0% in the previous month, and against market expectation for it to fall 8.9%. Additionally, the nation’s exports eased for the first time in 14-months, slumping 2.1% YoY in October, compared to a revised rise of 0.5% in the previous month, despite aggressive bond-buying by the BoJ. Investors had expected it to decline 2.0%.

Early this morning, the BoJ kept key interest rate unchanged at 0.1%. Additionally, the central bank maintained the monetary base at ¥80.0 trillion, on hopes that the economy is on its path to recovery, despite challenging global business conditions.

In other economic news, Japan’s all industry activity index unexpectedly declined 0.2% MoM in September, against market expectations for an advance of 0.2%, and after declining by a revised 0.1% in the previous month.

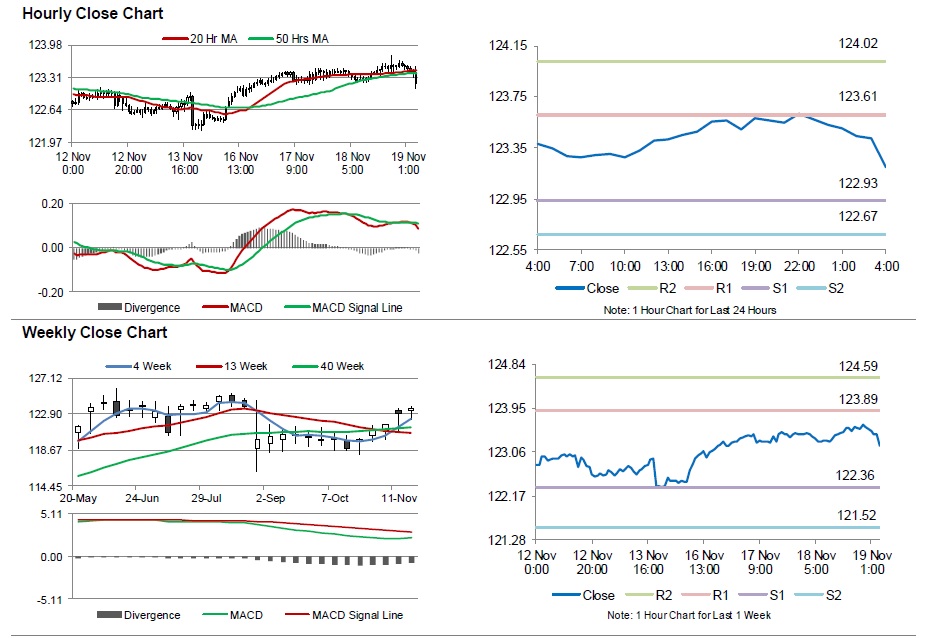

The pair is expected to find support at 122.93, and a fall through could take it to the next support level of 122.67. The pair is expected to find its first resistance at 123.61, and a rise through could take it to the next resistance level of 124.02.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.