For the 24 hours to 23:00 GMT, the USD rose 0.45% against the JPY and closed at 112.31.

In the Asian session, at GMT0400, the pair is trading at 112.04, with the USD trading 0.24% lower against the JPY from yesterday’s close.

According to the Bank of Japan’s (BoJ) summary of opinions report from its January meeting, board members saw improvements in Japan’s exports, consumer spending and capital expenditure. However, officials warned that it may take time for inflation expectations to pick up and that its 2.0% inflation target still remains elusive. At the meeting, the BoJ kept monetary policy steady and lifted its growth projection for the economy.

In other economic news, data showed that Japan’s trade surplus (BOP basis) advanced to a level of ¥806.8 billion in December, following a surplus of ¥313.4 billion in the previous month. Market anticipation was for a trade surplus of ¥751.1 billion.

Another set of data revealed that the nation’s Eco-Watchers survey for the current situation unexpectedly dropped to a level of 49.8 in January, against market consensus for it to climb to a level of 51.8 and compared to a reading of 51.4 in the prior month. Moreover, the nation’s Eco-Watchers survey for future outlook registered an unexpected drop to a level of 49.4 in January, while investors had envisaged for a rise to a level of 51.5 and after recording a level of 50.9 in the previous month.

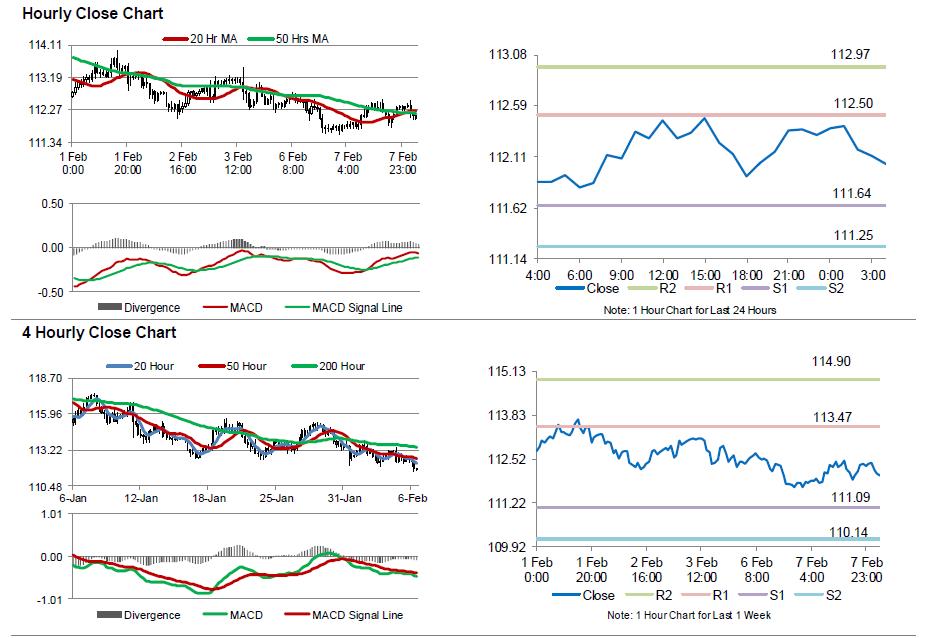

The pair is expected to find support at 111.64, and a fall through could take it to the next support level of 111.25. The pair is expected to find its first resistance at 112.5, and a rise through could take it to the next resistance level of 112.97.

Moving ahead, market participants would closely monitor Japan’s flash machine tool orders for January, slated to release tomorrow.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.