For the 24 hours to 23:00 GMT, the USD rose marginally against the JPY and closed at 104.84.

In the Asian session, at GMT0400, the pair is trading at 104.86, with the USD trading slightly higher against the JPY from yesterday’s close.

Earlier today, the Bank of Japan (BoJ), in its latest monetary policy meeting, held benchmark interest rate steady at -0.1%, in line with market expectations. However, the central bank pushed back the timeline for hitting the 2.0% inflation goal to around fiscal 2018, from fiscal 2017, following a raft of poor economic data and signalled that it will stand pat unless a severe market shock threatens to derail a fragile recovery.

In other economic news, data indicated that Japan’s final manufacturing PMI expanded to a level of 51.4 in October, marking its highest reading since January, offering signs of hope for an economy struggling to gain momentum. The PMI recorded a level of 50.4 in the previous month while the preliminary figures had recorded a rise to a level of 51.7.

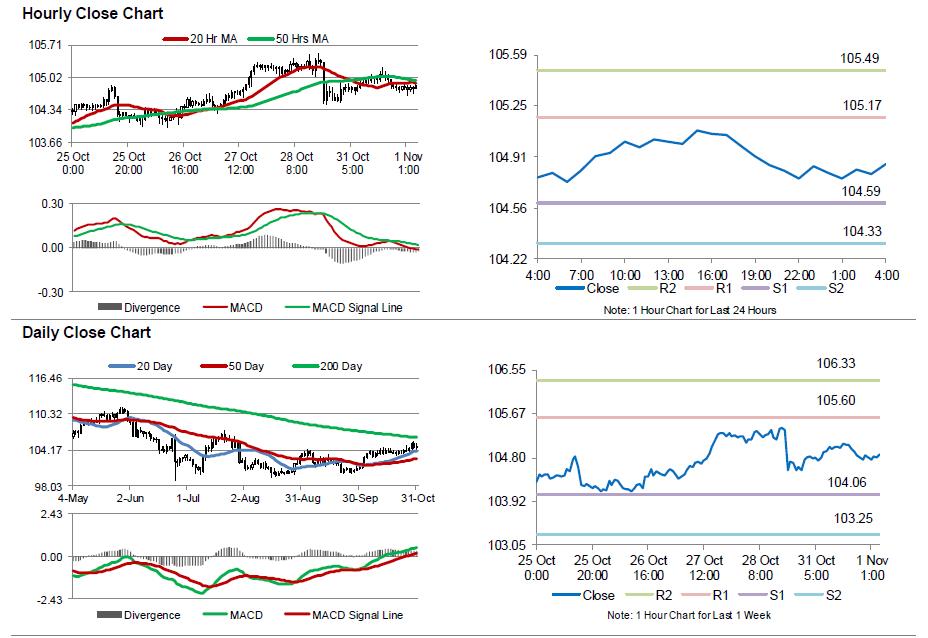

The pair is expected to find support at 104.59, and a fall through could take it to the next support level of 104.33. The pair is expected to find its first resistance at 105.17, and a rise through could take it to the next resistance level of 105.49.

Going ahead, investors would anxiously await a speech by the BoJ Governor, Haruhiko Kuroda, due in a while.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.