For the 24 hours to 23:00 GMT, the USD rose 0.63% against the JPY and closed at 113.07.

On the macro front, Japan’s preliminary industrial production retreated 2.9% on a yearly basis in September, compared to a rise of 0.2% in the previous month. Market participants had anticipated the industrial production to record a drop of 2.1%.

In the Asian session, at GMT0400, the pair is trading at 113.22, with the USD trading 0.13% higher against the JPY from yesterday’s close.

The Bank of Japan, in its October monetary policy meeting, opted to leave its benchmark interest rates unchanged at -0.10%, as widely expected and pledged to guide 10-year government bond yields at around 0%. Moreover, the central bank downgraded inflation forecast for 2019 to 1.9% from 2.0% and for 2020 to 2.0% from 2.1%. Meanwhile, real GDP growth outlook for both 2019 and 2020 was retained at 0.8%.

Earlier in the session, Japan’s consumer confidence index unexpectedly declined to a level of 43.0 in October, defying market expectations for an advance to a level of 43.5. The index had registered a level of 43.4 in the previous month. Also, housing starts slid 1.5% on an annual basis in September, compared to an advance of 1.6% in the prior month. On the contrary, Japan’s construction orders advanced 1.0% on a yearly basis in September, following a rise of 0.5% in the preceding month.

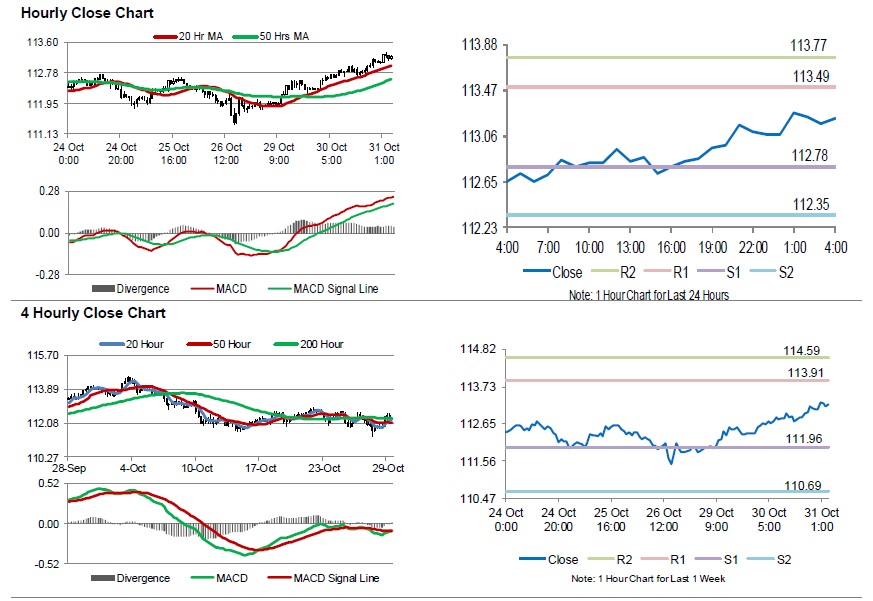

The pair is expected to find support at 112.78, and a fall through could take it to the next support level of 112.35. The pair is expected to find its first resistance at 113.49, and a rise through could take it to the next resistance level of 113.77.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.