For the 24 hours to 23:00 GMT, the USD declined 0.39% against the JPY and closed at 108.07.

In the Asian session, at GMT0300, the pair is trading at 107.59, with the USD trading 0.44% lower against the JPY from yesterday’s close.

The Bank of Japan (BoJ), in its June monetary policy meeting, decided to keep its key interest rate unchanged at -0.10%, as widely expected and pledged the yield target for 10-year Japanese government bonds around 0%. Further, the central bank’s stated that its July policy decision would be subject to the US Fed’s next policy move as well as progress in the US-China trade war.

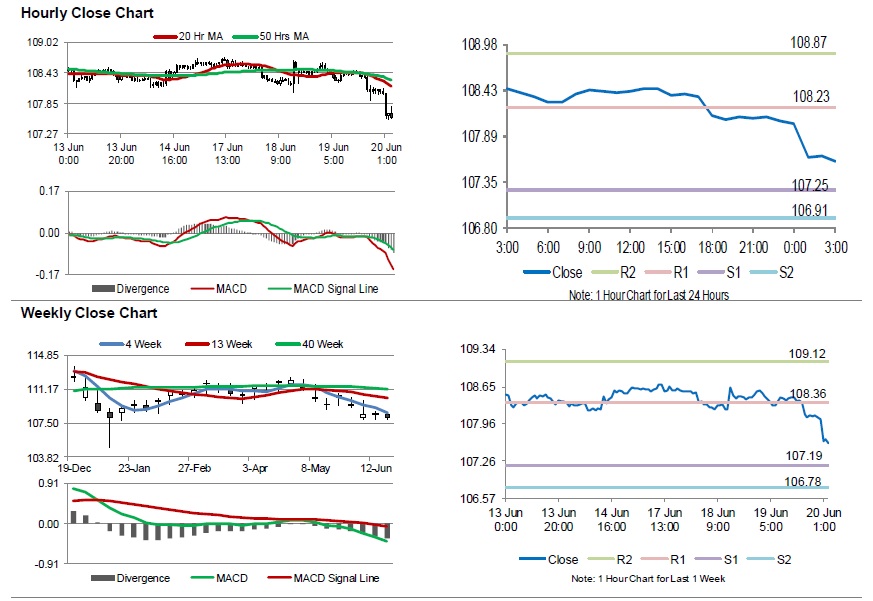

The pair is expected to find support at 107.25, and a fall through could take it to the next support level of 106.91. The pair is expected to find its first resistance at 108.23, and a rise through could take it to the next resistance level of 108.87.

Moving ahead, traders would keep an eye on Japan’s national consumer price index for May and the Nikkei manufacturing PMI for June, set to release overnight

The currency pair is trading below its 20 Hr and 50 Hr moving averages.