For the 24 hours to 23:00 GMT, the USD rose 0.33% against the JPY and closed at 108.84.

In the Asian session, at GMT0300, the pair is trading at 108.71, with the USD trading 0.12% lower against the JPY from yesterday’s close.

The Bank of Japan (BoJ), in its July monetary policy meeting, opted to leave its benchmark interest rate unchanged at -0.10%, as widely. The central bank stated that it will take additional easing measures if the economy loses momentum toward achieving the target inflation rate of 2%. Further, the bank decided to maintain interest rates at current ultra-low levels at least through around spring 2020. Meanwhile, the BoJ lowered its inflation forecast for fiscal 2019 to 1.0% from 1.1% and also downgraded its growth outlook for the fiscal 2019 to 0.7% from 0.8%.

On the macro front, Japan’s unemployment rate unexpectedly fell to 2.3% in June, defying market expectations for an unchanged reading. In the previous month, unemployment rate had recorded a reading of 2.4%. Meanwhile, the nation’s flash industrial production dropped 4.1% on an annual basis in June, marking its largest fall in 1 year and more than market consensus for a fall of 2.0%. In the prior month, industrial production slid 2.1%.

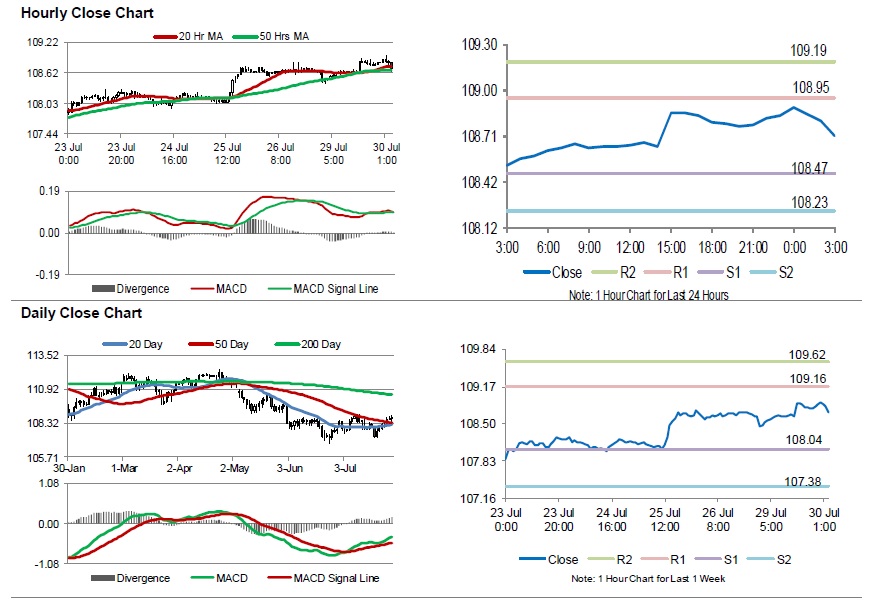

The pair is expected to find support at 108.47, and a fall through could take it to the next support level of 108.23. The pair is expected to find its first resistance at 108.95, and a rise through could take it to the next resistance level of 109.19.

In absence of key economic releases in Japan today, investor sentiment would be determined by global macroeconomic events.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.