For the 24 hours to 23:00 GMT, the USD declined 0.11% against the JPY and closed at 101.72.

In the Asian session, at GMT0300, the pair is trading at 101.5, with the USD trading 0.22% lower against the JPY from yesterday’s close.

Early this morning, the Bank of Japan (BoJ), in its latest monetary policy meeting, left the benchmark interest rate at -0.1%, in line with market expectations and held its monetary policy base at an annual pace of ¥80.0 trillion.

Separately, overnight data revealed that Japan unexpectedly posted a total merchandise trade deficit of ¥18.7 billion in August, for the first time in three months, from a revised trade surplus of ¥513.6 billion in the prior month whereas markets had envisaged the nation to record a trade surplus of ¥191.0 billion. Moreover, the nation’s exports declined by 9.6% on an annual basis in August, compared to a fall of 14.0% in the prior month. Also, imports slid 17.3% YoY in August, following a drop of 24.7% in the prior month.

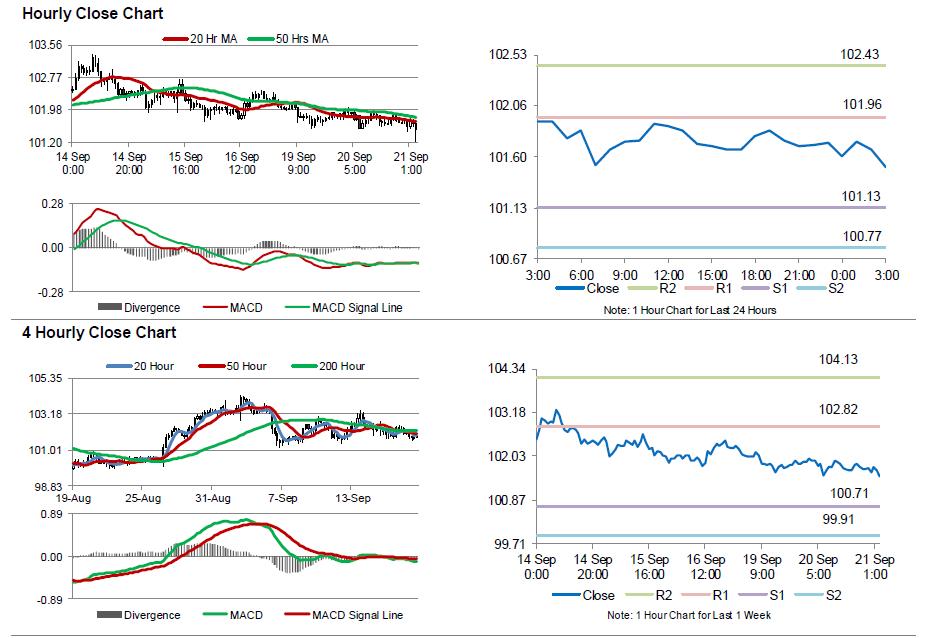

The pair is expected to find support at 101.13, and a fall through could take it to the next support level of 100.77. The pair is expected to find its first resistance at 101.96, and a rise through could take it to the next resistance level of 102.43.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.