For the 24 hours to 23:00 GMT, the USD declined 0.07% against the JPY and closed at 108.79.

In the Asian session, at GMT0400, the pair is trading at 108.63, with the USD trading 0.15% lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s preliminary industrial production unexpectedly advanced 1.1% on an annual basis in September, defying market consensus for a fall of 4.1%. In the prior month, industrial production had recorded a drop of 4.7%.

The Bank of Japan (BoJ), in its latest monetary policy meeting, opted to leave its benchmark interest rate unchanged at -0.1%, as widely expected and pledged to its guide 10-year government bond yields around 0%. However, the central bank indicated that it may lower interest rates in future, amid ongoing global trade tensions..

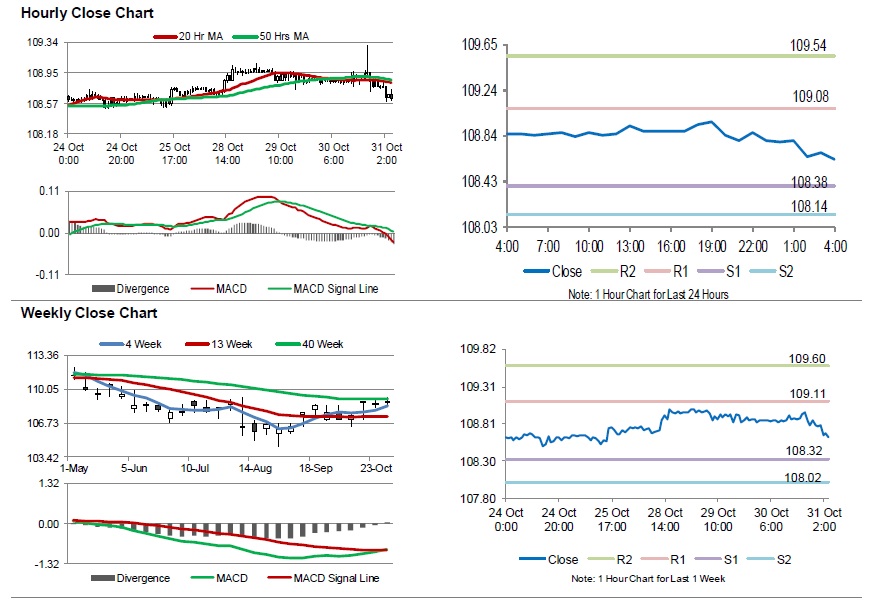

The pair is expected to find support at 108.38, and a fall through could take it to the next support level of 108.14. The pair is expected to find its first resistance at 109.08, and a rise through could take it to the next resistance level of 109.54.

Trading trend in the Japanese Yen today, is expected to be determined by Japan’s construction orders and housing starts, both for September along with consumer confidence index for October, set to release in a while.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.