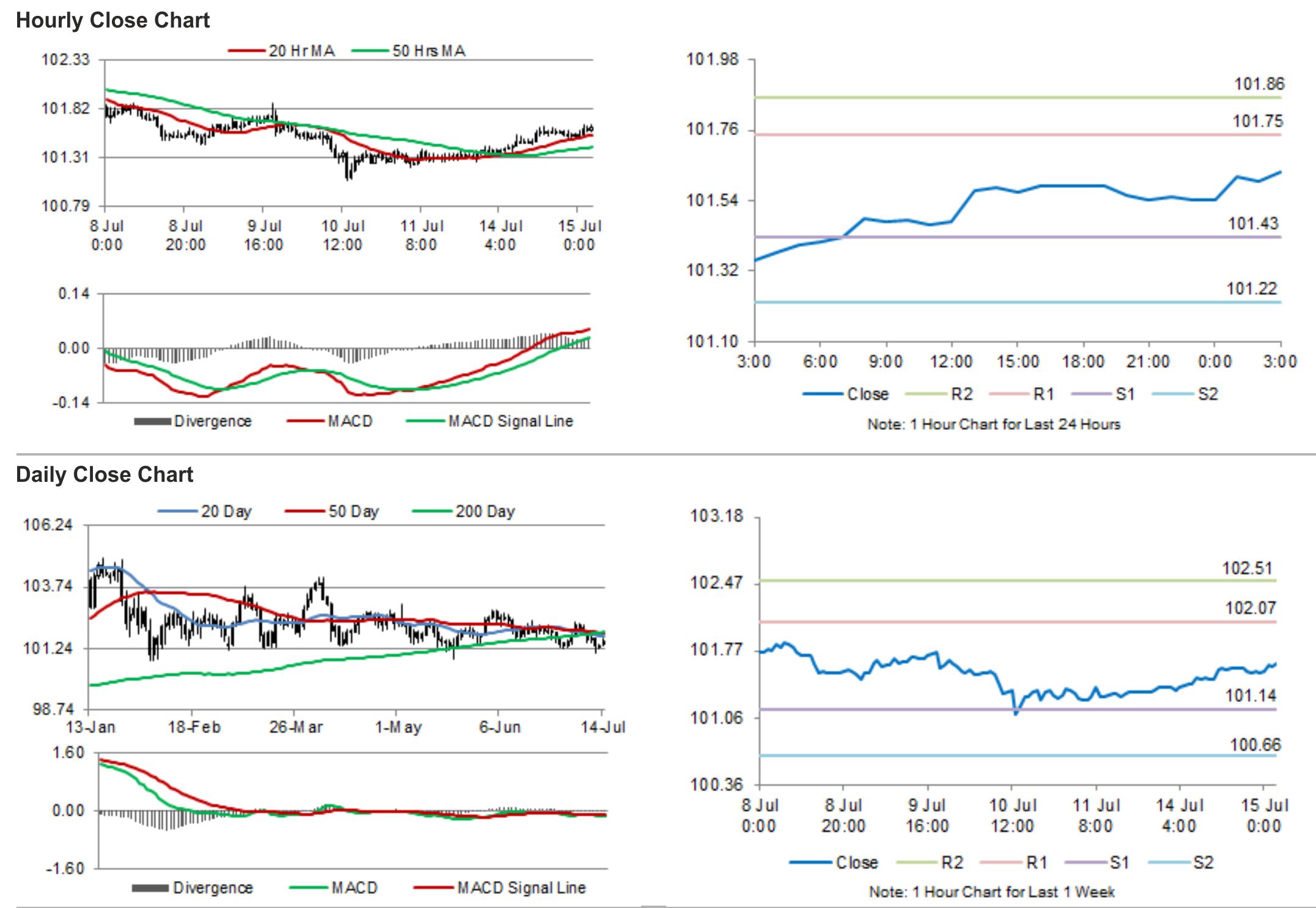

For the 24 hours to 23:00 GMT, the USD strengthened 0.16% against the JPY and closed at 101.54.

In the Asian session, at GMT0300, the pair is trading at 101.63, with the USD trading 0.09% higher from yesterday’s close.

The Japanese Yen lost ground after the Bank of Japan, in its monetary policy meeting reduced its economic growth outlook of Japan, citing downbeat exports and a sharp drop in household spending post the April sales tax hike. Meanwhile, the central bank as widely expected kept its vast stimulus programme steady, stating that the nation is recovering at a moderate pace.

The pair is expected to find support at 101.43, and a fall through could take it to the next support level of 101.22. The pair is expected to find its first resistance at 101.75, and a rise through could take it to the next resistance level of 101.86.

Trading trends in the pair today are expected to be determined by the Bank of Japan Governor, Haruhiko Kuroda’s speech scheduled today, who would provide further insights on the BoJ’s plans to encourage recovery in the nation.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.