For the 24 hours to 23:00 GMT, the USD declined 0.25% against the JPY and closed at 111.35.

In the Asian session, at GMT0300, the pair is trading at 111.29, with the USD trading marginally lower against the JPY from yesterday’s close.

According to minutes of the Bank of Japan’s (BoJ) April meeting minutes, policymakers grew more optimistic about Japanese exports and industrial production, but expressed caution on inflation expectations. Further, the policymakers agreed that the amount of government debt purchases will fluctuate under its quantitative easing programme, but this was unlikely to affect its guidance.

On the data front, Japan’s all industry activity index recorded a rise of 2.1% on a monthly basis in April, more than market expectations for a gain of 1.6% and after recording a revised drop of 0.7% in the prior month.

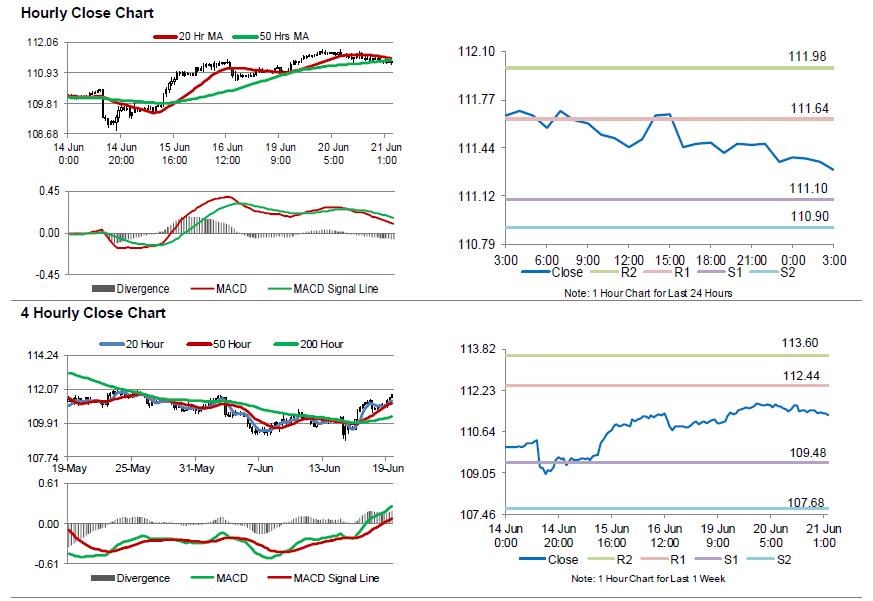

The pair is expected to find support at 111.10, and a fall through could take it to the next support level of 110.90. The pair is expected to find its first resistance at 111.64, and a rise through could take it to the next resistance level of 111.98.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.