For the 24 hours to 23:00 GMT, the USD weakened 0.83% against the JPY and closed at 103.88.

In the Asian session, at GMT0300, the pair is trading at 103.97, with the USD trading 0.09% higher against the JPY from yesterday’s close.

Overnight, the Bank of Japan’s (BoJ) April meeting minutes showed that the board members expressed doubts on its ability to attain the 2.0% sustained inflation goal. A few policymakers believed that that the central bank should continue to examine the risks faced by Japan from overseas economies and ease monetary policy without hesitation in future if needed. At the meeting, most members agreed that the BoJ could afford to take a wait-and-see stance because it would take time for negative interest rates and the debt purchasing programme to have an impact.

This morning, data showed that Japan’s all industry activity index advanced more-than-expected by 1.3% MoM in April, following a 0.2% increase in the previous month.

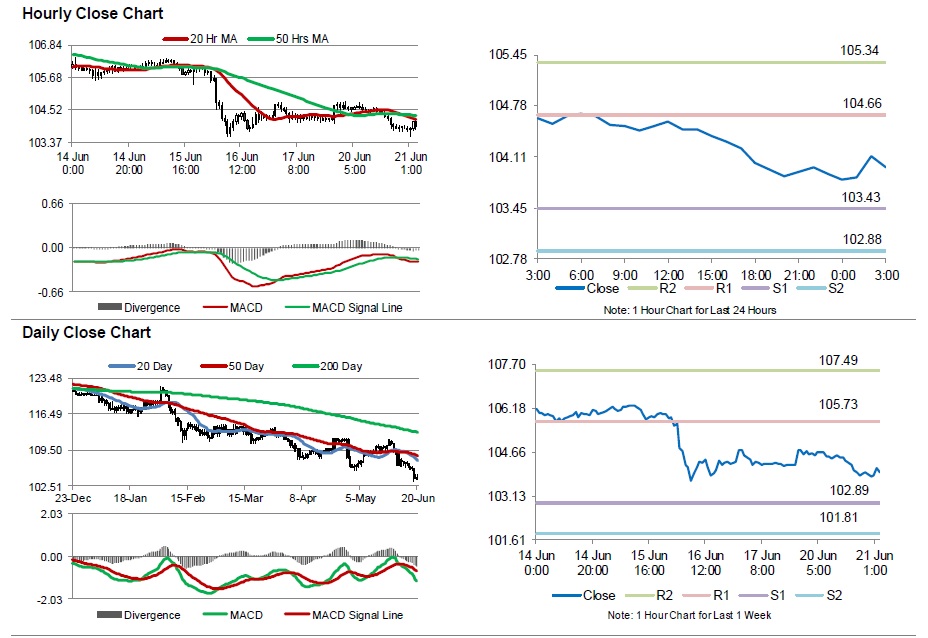

The pair is expected to find support at 103.43, and a fall through could take it to the next support level of 102.88. The pair is expected to find its first resistance at 104.66, and a rise through could take it to the next resistance level of 105.34.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.