For the 24 hours to 23:00 GMT, the USD rose 0.41% against the JPY and closed at 111.50.

Yesterday, the OECD, warned that the Bank of Japan (BoJ) should reassess its loose monetary policy if it is unable to meet its inflation target for a prolonged time, otherwise it could end up holding too much government debt. The OECD slightly lowered Japanese economic growth forecast to 1.5% in 2017 and added that the nation’s economic growth is expected to slow from 2018 as the government provides less fiscal stimulus.

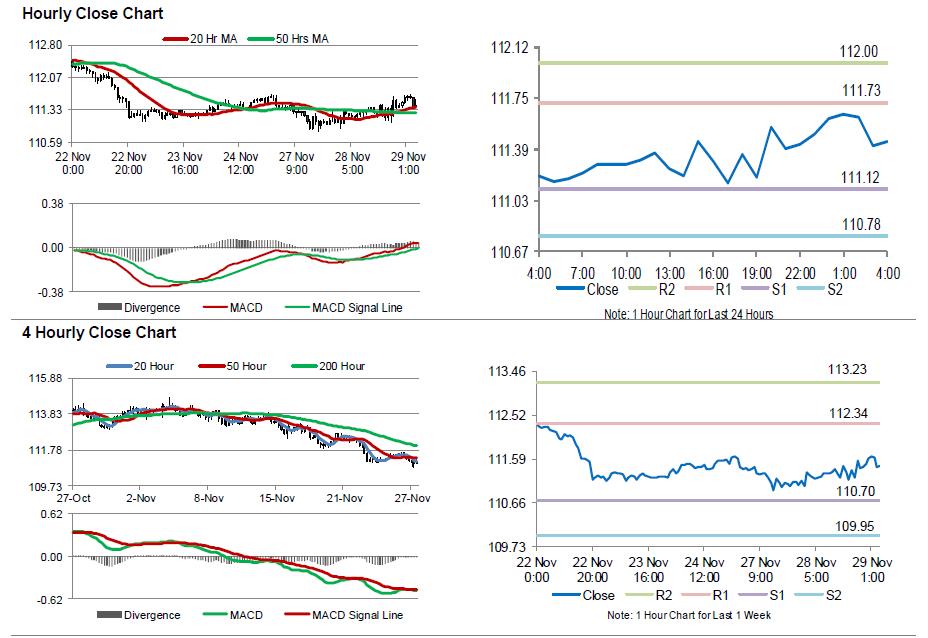

In the Asian session, at GMT0400, the pair is trading at 111.45, with the USD trading slightly lower against the JPY from yesterday’s close.

Overnight data revealed that Japan’s retail trade remained flat on a monthly basis in October, against market expectations for a rise of 0.2%. Retail trade had advanced 0.8% in the prior month. Meanwhile, the nation’s large retailers’ sales declined less-than-anticipated by 0.7% in October, compared to a gain of 1.9% in the prior month, while markets were anticipating for a fall of 0.8%.

The pair is expected to find support at 111.12, and a fall through could take it to the next support level of 110.78. The pair is expected to find its first resistance at 111.73, and a rise through could take it to the next resistance level of 112.00.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.