For the 24 hours to 23:00 GMT, the USD weakened marginally against the JPY and closed at 102.51.

Yesterday, in Japan, Koichi Hamada, a key aide to Prime Minister, Shinzo Abe, suggested the Bank of Japan (BoJ) to wait for more economic data due in summer before deciding whether to ease its monetary policy further. Furthermore, he expressed uncertainty on the effects of the sale tax hike on the economy and asked the central bank to “examine the economy closely when economic data reflecting the tax hike come out.”

In the Asian session, at GMT0400, the pair is trading at 102.56, with the USD trading slightly higher from yesterday’s close.

On the economic front, Japan’s corporate service price index rose 0.8% (YoY) in January, less than market expectations for a 1.2% increase and compared to previous month’s rise of 1.1%.

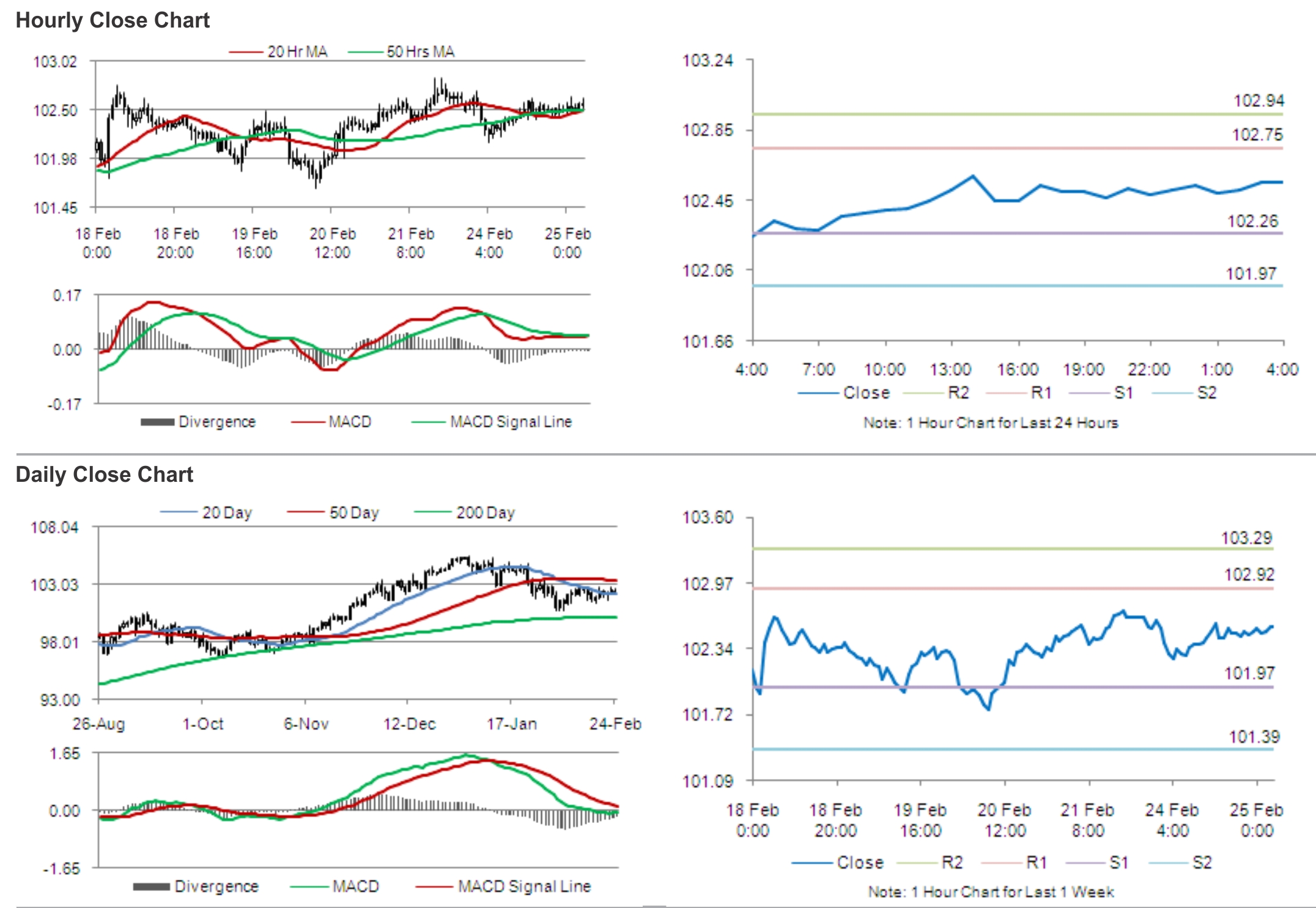

The pair is expected to find support at 102.26, and a fall through could take it to the next support level of 101.97. The pair is expected to find its first resistance at 102.75, and a rise through could take it to the next resistance level of 102.94.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.