For the 24 hours to 23:00 GMT, the USD strengthened marginally against the JPY and closed at 102.32.

Yesterday, the Bank of Japan (BoJ) Board Member, Yoshihisa Morimoto, opined that, despite the soft external demand, he did not foresee any risks to the economic-outlook of the Japanese economy. Furthermore, he reiterated the BoJ’s Governor, Haruhiko Kuroda’s stance that the central bank is prepared to adjust its policy if risks materialise in the economy.

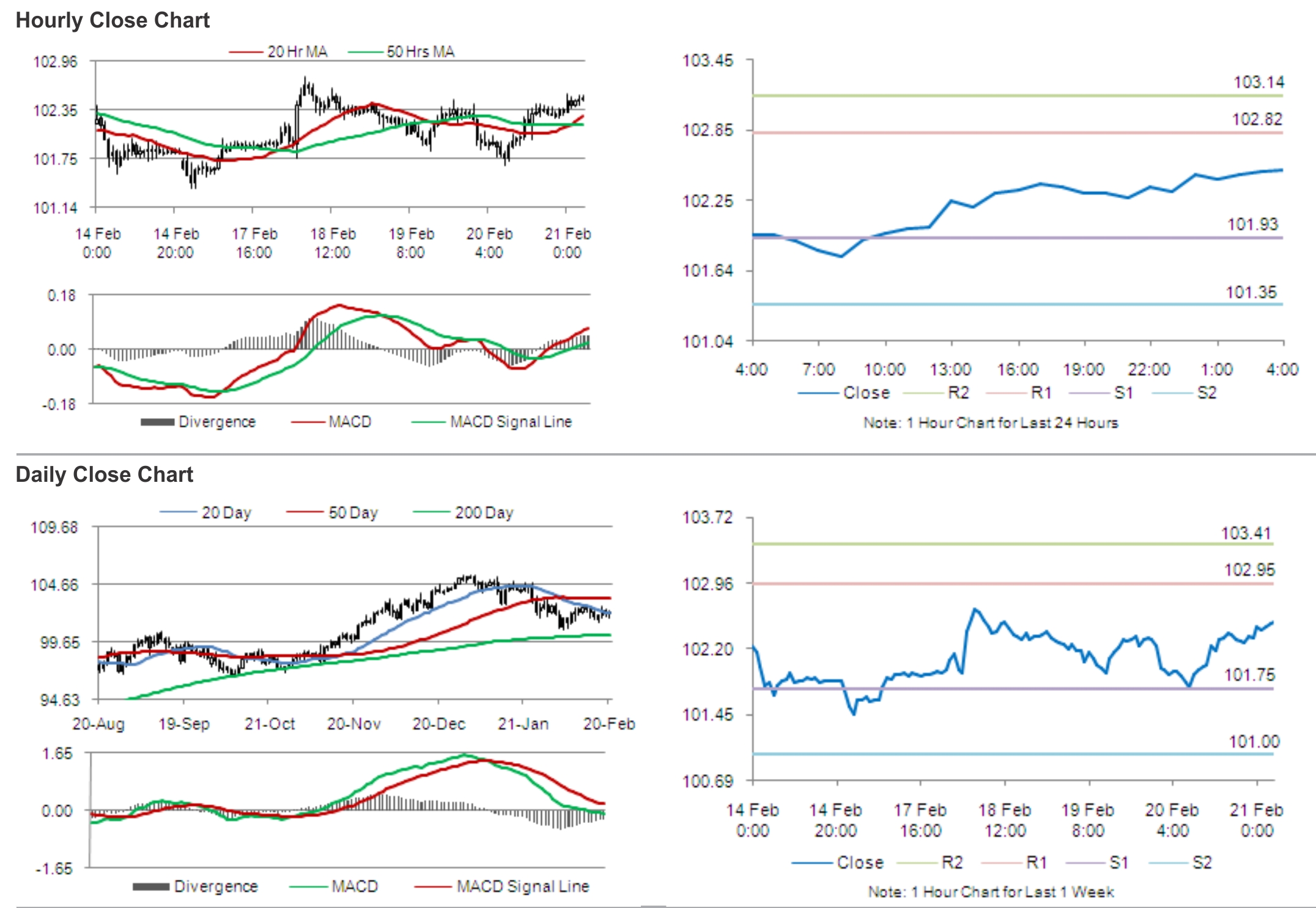

In the Asian session, at GMT0400, the pair is trading at 102.50, with the USD trading 0.18% higher from yesterday’s close.

Earlier today, the minutes from the BoJ’s January 21-22 policy meeting, revealed policymakers’ view that the central bank’s ultra-easy policy need not strictly end in two years time frame. The minutes also showed that economic recovery in Japan is expected to continue and inflation to rise gradually, despite the prevailing downside risks to the economy’s recovery.

The pair is expected to find support at 101.93, and a fall through could take it to the next support level of 101.35. The pair is expected to find its first resistance at 102.82, and a rise through could take it to the next resistance level of 103.14.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.