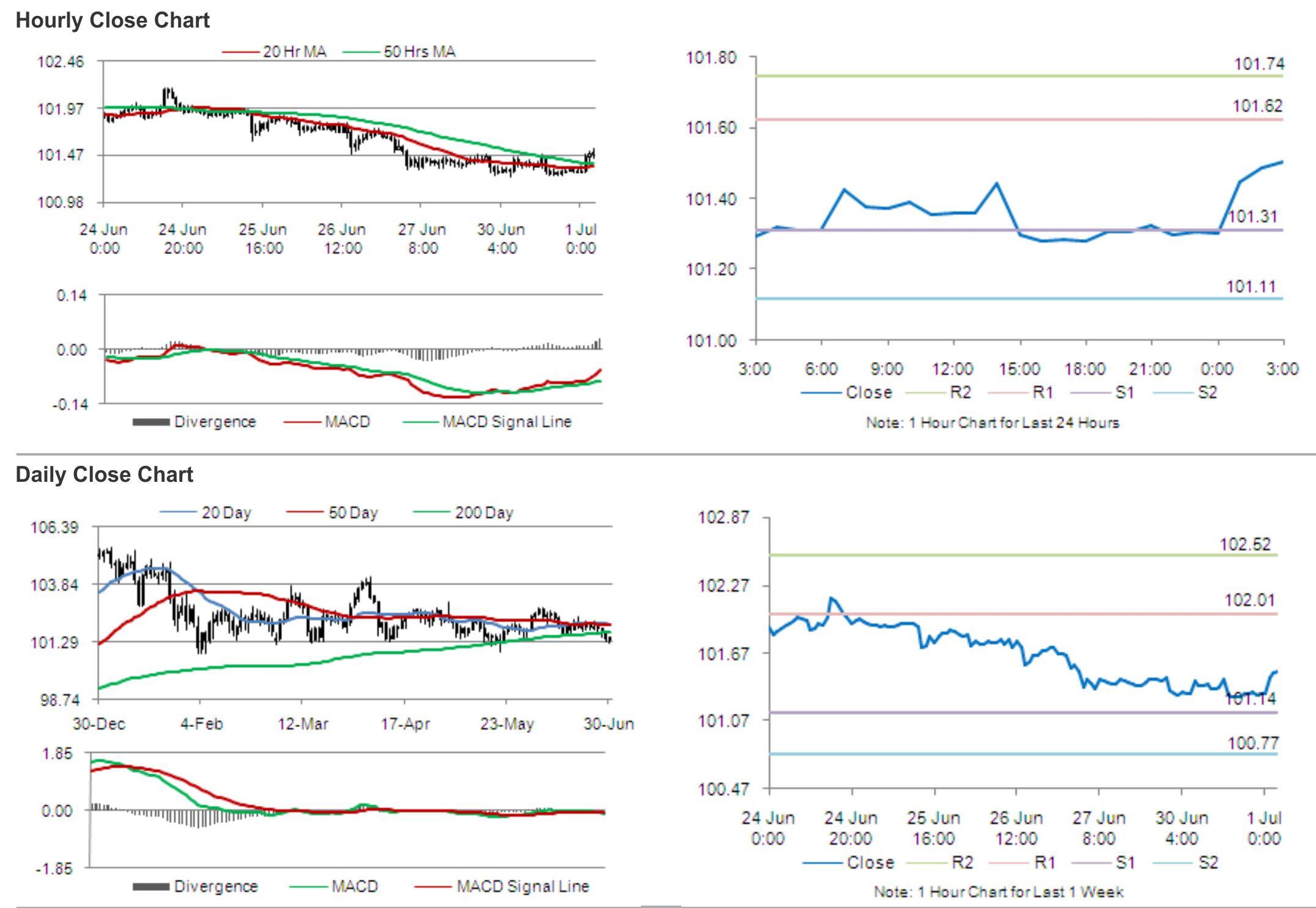

For the 24 hours to 23:00 GMT, the USD weakened 0.11% against the JPY and closed at 101.31.

On the economic front, housing starts in Japan dropped 15.0% (YoY) to 67,791 units in May, the lowest for the month in three years, while construction orders increased 13.7% (YoY) in May, following a 104.9% surge in April.

In the Asian session, at GMT0300, the pair is trading at 101.50, with the USD trading 0.19% higher from yesterday’s close.

Early morning, the BoJ, in its quarterly “tankan” survey, reported that its index measuring confidence among big manufacturers’ fell by 5.0 points to a reading of 12.0, while its index on non-manufacturing business sentiment edged down to a level of 19.0 in the second quarter, following the April sales-tax hike. However, the tankan outlook index for large manufacturers advanced to a reading of 15.0, while that of the non-manufacturing businesses advanced to a figure of 19.0 in the second quarter of 2014. Separately, another report revealed that Japanese manufacturing activity expanded at a faster pace in June, taking its Markit/JMMA manufacturing PMI to a seasonally adjusted reading of 51.5 in June, from its preliminary reading of 51.1.

The pair is expected to find support at 101.31, and a fall through could take it to the next support level of 101.11. The pair is expected to find its first resistance at 101.62, and a rise through could take it to the next resistance level of 101.74.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.