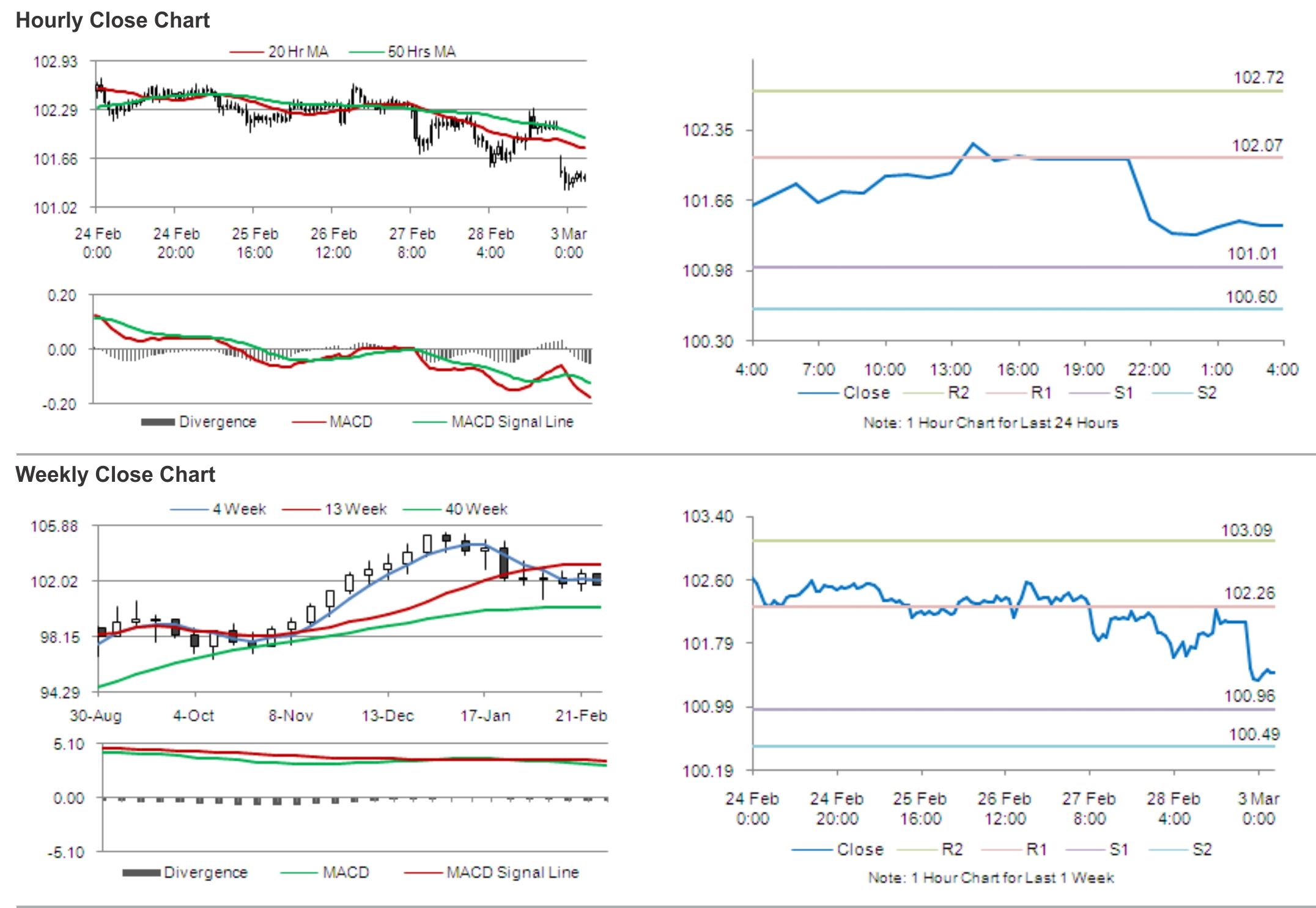

On Friday, the USD marginally weakened against the JPY and closed at 102.07, following a lacklustre fourth-quarter US annualised GDP data.

In the Asian session, at GMT0400, the pair is trading at 101.42, with the USD trading 0.63% lower from Friday’s close.

This morning, the Japanese Yen was buoyed after the demand for safe havens received a boost following the Russian President Vladimir Putin’s threat to invade Ukraine. Earlier today, the Ministry of Finance Japan reported that capital spending in the nation rose 4.0% in the fourth quarter, less than analysts’ call for a 5.1% rise and compared to a 1.5% increase registered in the preceding month.

The pair is expected to find support at 101.01, and a fall through could take it to the next support level of 100.60. The pair is expected to find its first resistance at 102.07, and a rise through could take it to the next resistance level of 102.72.

During the later course of the day, the Bank of Japan (BoJ) is expected to release a report on the monetary base of the nation for February.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.