For the 24 hours to 23:00 GMT, the USD weakened 1.03% against the JPY and closed at 101.78. The Japanese Yen advanced against the US Dollar as soft economic data from China and lingering concerns on Ukraine crisis, spurred demand for safe-haven assets.

In the Asian session, at GMT0400, the pair is trading at 101.67, with the USD trading 0.11% lower from yesterday’s close.

Earlier today, the minutes from the Bank of Japan’s (BoJ) February 17-18 meeting showed that economic growth and price movement in the Japan were in-line with the central bank’s forecast. The minutes also highlighted policymakers’ view that the economy would continue to expand at a moderate pace and that a planned sales tax hike in April would not derail the recovery in the nation.

In economic news, a report showed that industrial production in Japan rose 3.8% (MoM) in February, less than analysts’ call for a 4.0% increase and compared to a 0.9% rise registered in the previous month. Another report revealed that capacity utilization in Japan rose 5.9% in January, following a 2.2% rise in the preceding month.

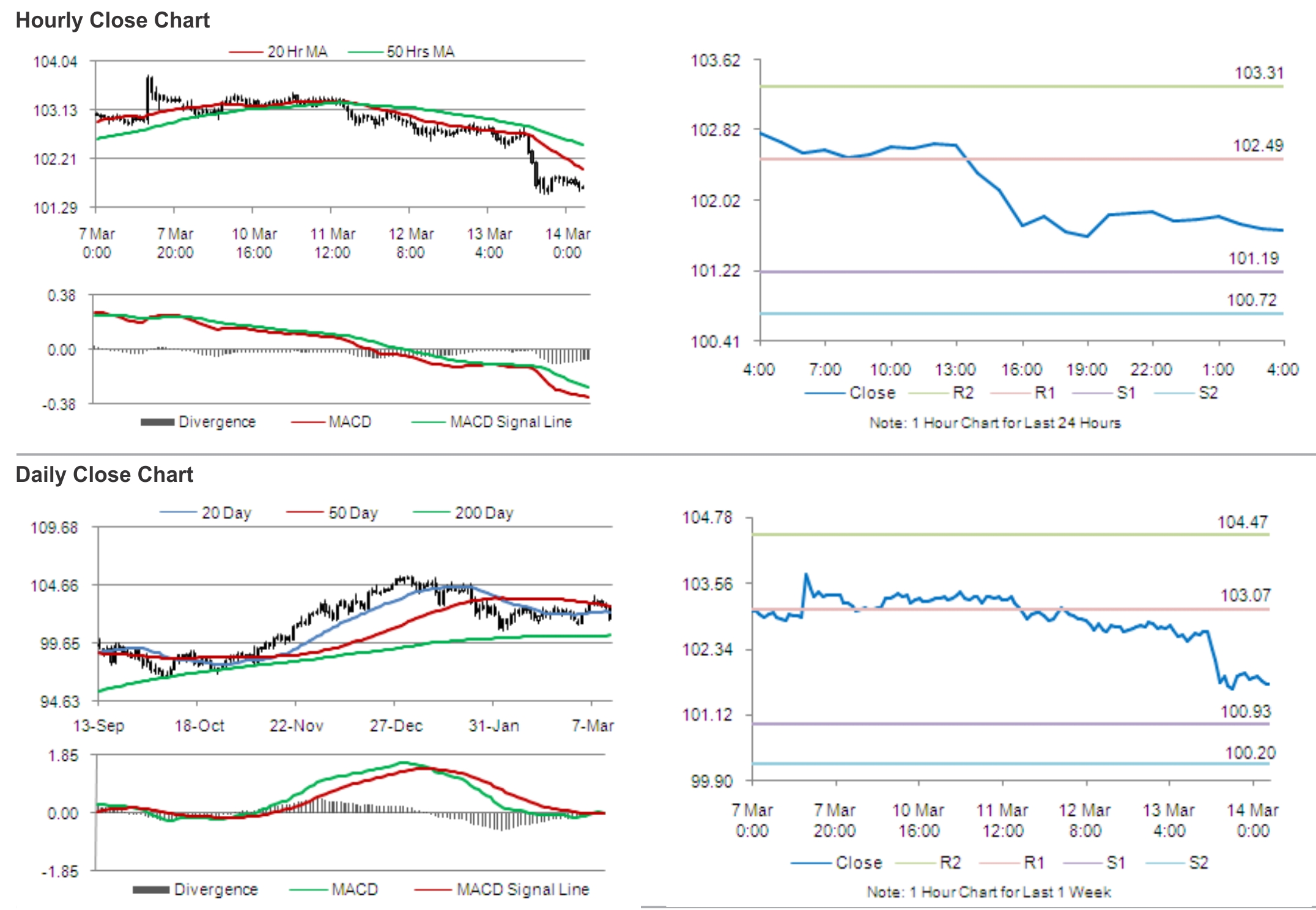

The pair is expected to find support at 101.19, and a fall through could take it to the next support level of 100.72. The pair is expected to find its first resistance at 102.49, and a rise through could take it to the next resistance level of 103.31.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.