For the 24 hours to 23:00 GMT, USD strengthened 0.08% against the JPY and closed at 79.13.

Bank of Japan Deputy Governor, Hirohide Yamaguchi has stated that he is focusing on the negative impact a stronger yen could have on the economy, indicating the central bank’s readiness to ease monetary policy further if sharp yen gains threaten a fragile recovery.

In Japan, yesterday, on an annual basis, the department store sales increased by 0.3% to ¥492.7 billion in June, following a 2.4% decline recorded in May. Additionally, sales in the Tokyo metropolitan area rose by 0.4% (Y-o-Y) to ¥125.9 billion in June, the first gain in four months.

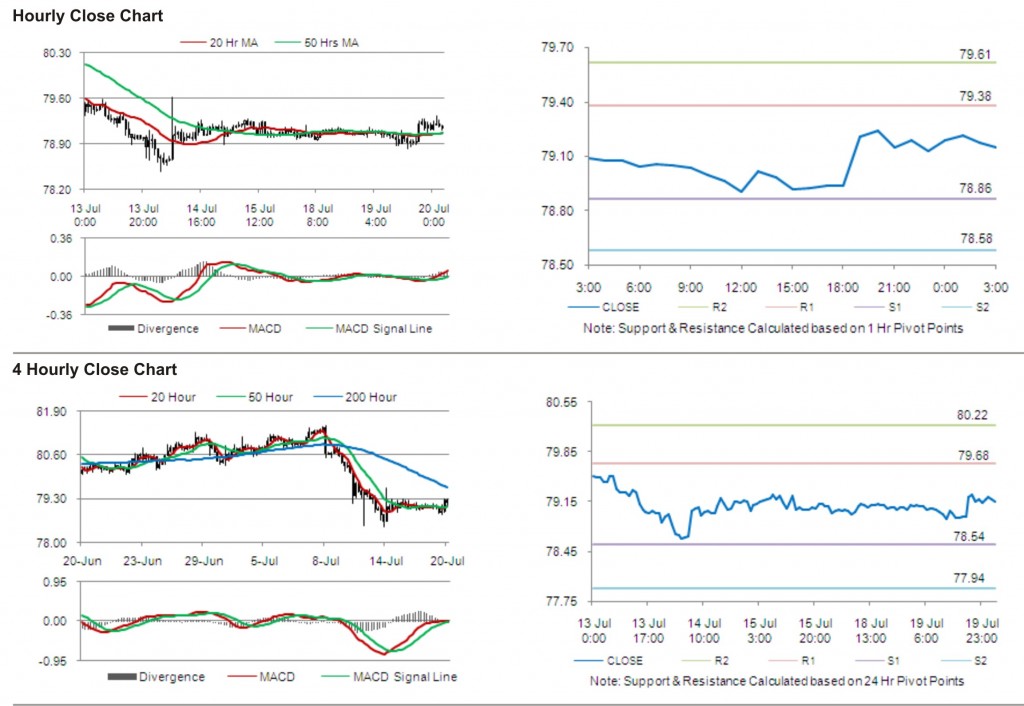

In the Asian session at 3:00GMT, the pair is trading marginally higher from yesterday’s close at 23:00 GMT, at 79.15.

The first short term resistance is at 79.38, followed by 79.61. The pair is expected to find support at 78.86 and the subsequent support level at 78.58.

With a series of Japan economic releases today, including coincident index and leading economic index, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving average.