On Friday, for the 24 hours to 23:00 GMT, USD strengthened 0.85% against the JPY and closed at 84.07.

Automobile Dealers Association reported that annual automobile sales in Japan fell 37.0% in March to 279,389.

The Minneapolis Federal Reserve Bank President, Narayana Kocherlakota stated that the bursting of an asset price bubble would not have any impact on unemployment or output if central bank policy is “sufficiently accommodative”.

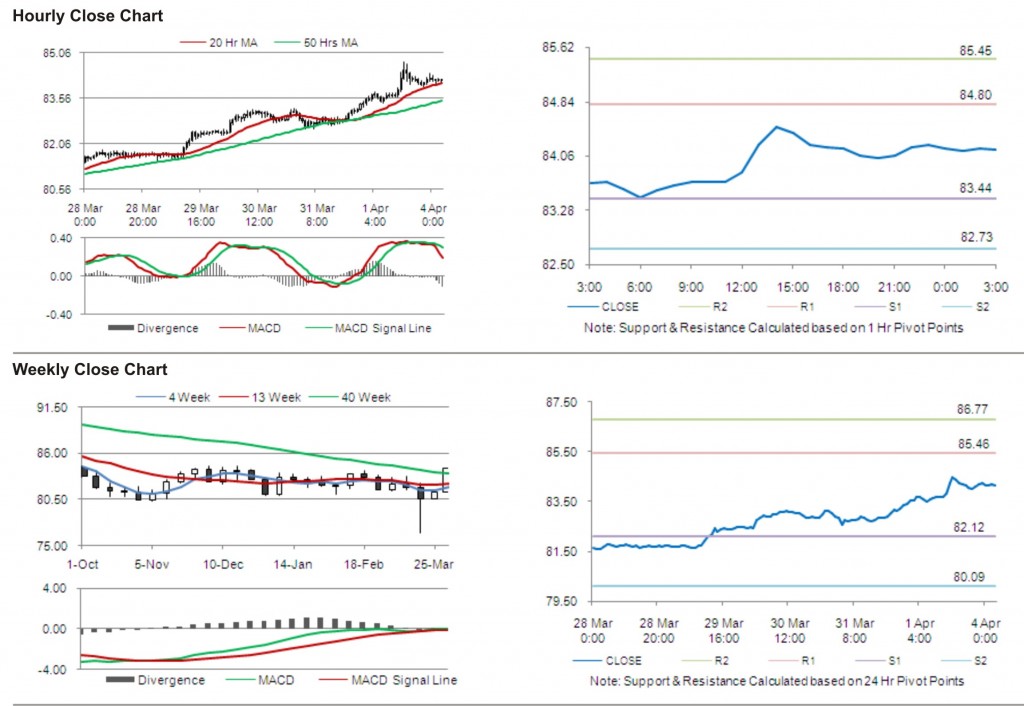

In the Asian session at 3:00GMT, the pair is trading higher/lower from the New York close, by 0.10%, at 84.15.

The first short term resistance is at 84.80, followed by 85.45. The pair is expected to find support at 83.44 and the subsequent support level at 82.73.

Trading trends in the pair today are expected to be determined by Tokyo Average Office Vacancies due to be released in Japan, later today.

The currency pair is showing convergence with 20 Hr moving average and is trading just above its 50 Hr moving average.