On Friday, the USD marginally strengthened against the JPY and closed at 101.75.

In economic news, housing starts in Japan fell less-than-expected 3.3% (YoY) in April while Japanese construction orders surged 104.9%, compared to an 8.8% decline recorded in the previous month. Meanwhile, the IMF, in its latest report, projected Japan to achieve its 2.0% inflation target by 2017 while urging the BoJ to maintain its current aggressive pace of monetary easing for an extended period to stave off deflation threat.

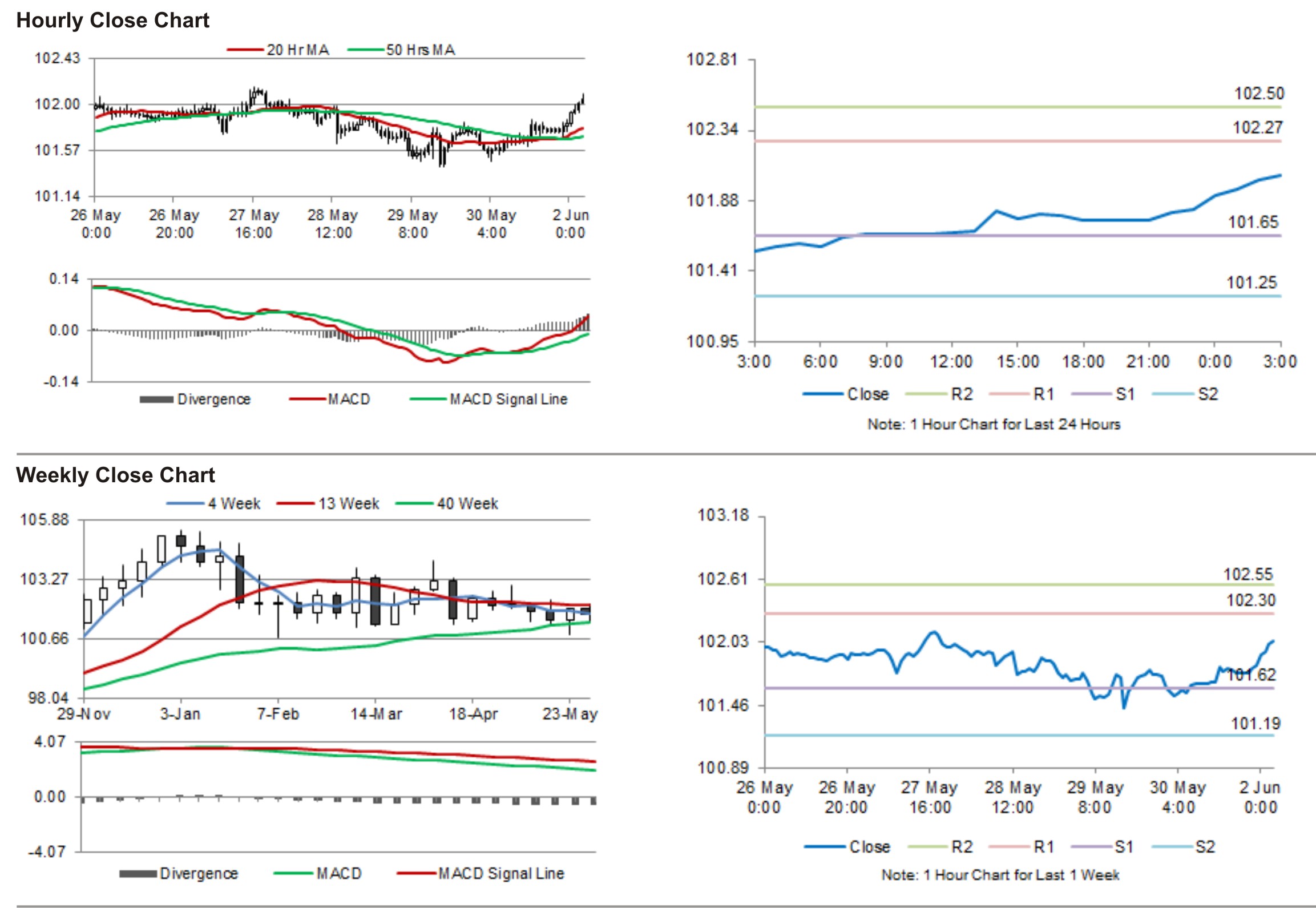

In the Asian session, at GMT0300, the pair is trading at 102.05, with the USD trading 0.29% higher from Friday’s close.

Early morning data from Japan showed that capital spending in the nation jumped 7.4% from a year earlier in the January-March period while the Nomura/ JMMA manufacturing purchasing manager index stood pat at previous month’s reading of 49.9 in May.

The pair is expected to find support at 101.65, and a fall through could take it to the next support level of 101.25. The pair is expected to find its first resistance at 102.27, and a rise through could take it to the next resistance level of 102.50.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.