For the 24 hours to 23:00 GMT, the USD weakened 1.08% against the JPY and closed at 101.96.

In Japan, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda, following the central bank’s decision to keep its monetary policy intact, stated that the Japanese economy is well able to withstand a sales tax hike without immediate additional stimulus measures. Furthermore, the central bank governor indicated that he is “as convinced as before” that the BoJ can defeat 15 years of deflation in the nation and spur 2% inflation by next spring.

Yesterday, the International Monetary Fund slashed its 2014 growth forecast for Japan and cautioned that the nation’s Prime Minister, Shinzo Abe should stick to his pre-decided reforms if he really wants to see a stronger recovery in the world’s third largest economy.

On the economic front, the Cabinet Office reported that it’s Eco Watchers Survey on the current situation of the Japanese economy rose more-than-expected to a reading of 57.9 in March while its survey on the outlook weakened to a level of 34.7 last month.

In the Asian session, at GMT0300, the pair is trading at 101.92, with the USD trading slightly lower from yesterday’s close.

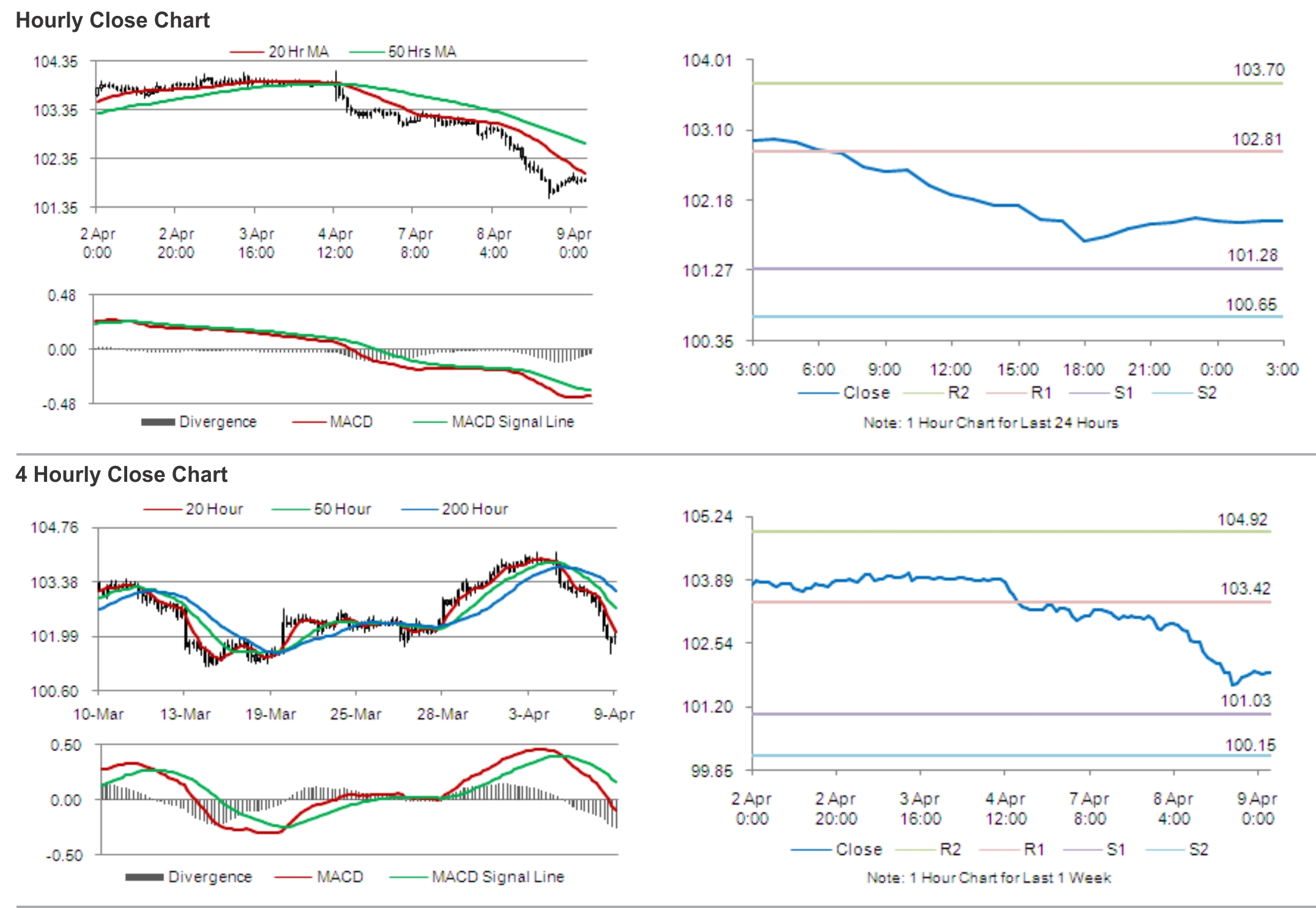

The pair is expected to find support at 101.28, and a fall through could take it to the next support level of 100.65. The pair is expected to find its first resistance at 102.81, and a rise through could take it to the next resistance level of 103.70.

Market participants are expected to keep a tab on the BoJ’s monthly economic survey and the Cabinet Office’s report on Japan’s machinery orders, slated for release later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.