For the 24 hours to 23:00 GMT, the USD slightly weakened against the JPY and closed at 101.88.

Yesterday, Japan’s Chief Cabinet Secretary, Yoshihide Suga indicated that, during a lunch meeting, Japan Prime Minster, Shinzo Abe and the BoJ Governor, Kuroda “took plenty of time to discuss economic conditions” however, the nation’s Prime Minister did not pressurize the central bank Chief to ease policy further.

In the Asian session, at GMT0300, the pair is trading at 102.22, with the USD trading 0.33% higher from yesterday’s close.

Earlier today, the BoJ, Chief, Haruhiko Kuroda reaffirmed his upbeat view on the growth of the Japanese economy by reiterating that Japan is making progress towards the central bank’s 2% inflation goal and by adding that growth in the world’s third largest economy to pick up around mid-year as the sting of a sales tax hike fades. Separately, Japanese Finance Minister, Taro Aso, during a parliamentary session, stated that the downturn in the nation’s consumption in reaction to the sales tax hike was smaller than what he had expected.

On the economic front, industrial production in Japan fell 2.3% (MoM) in February, in-line with analysts’ estimates and compared to a 3.8% (MoM) increase in January.

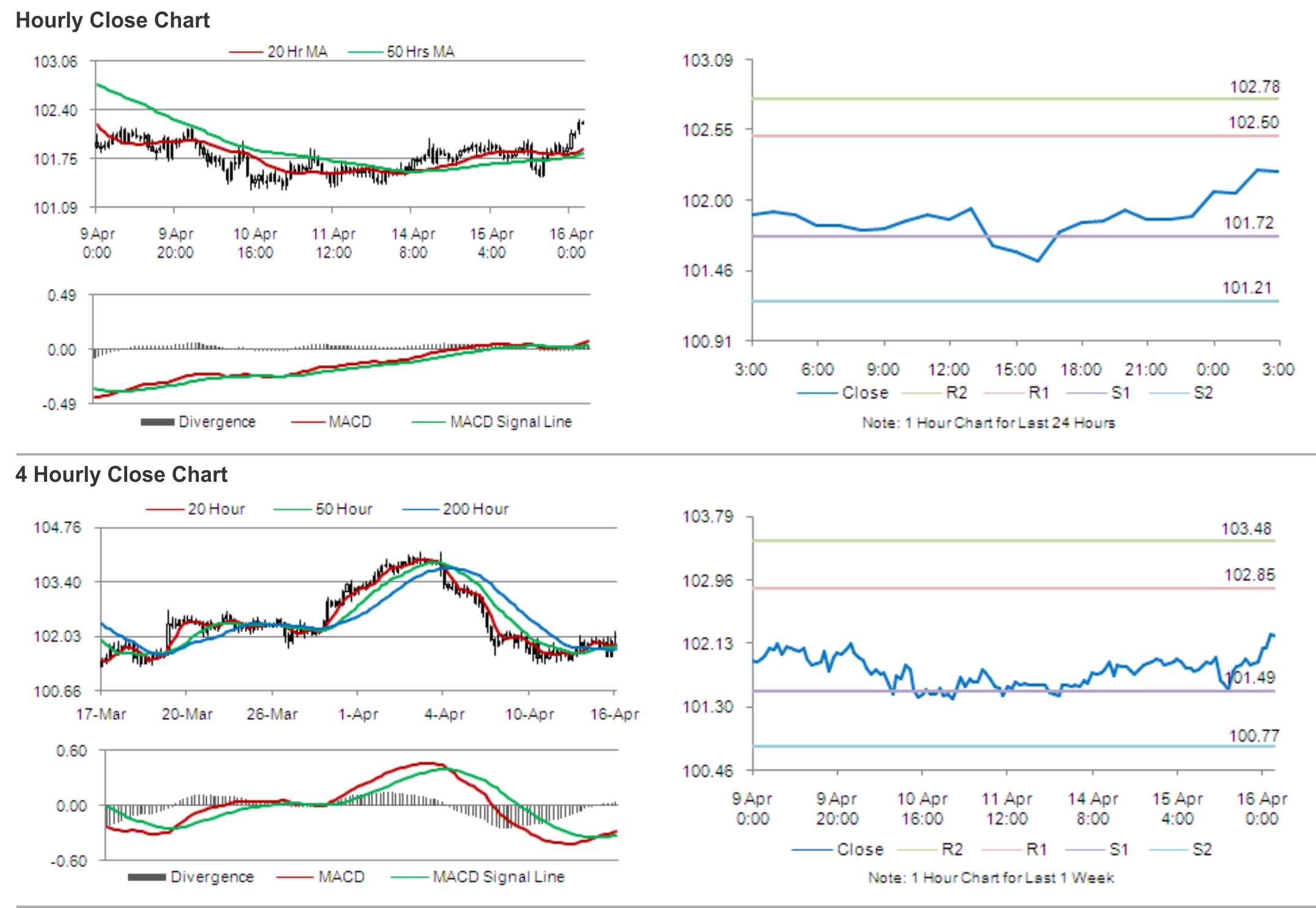

The pair is expected to find support at 101.72, and a fall through could take it to the next support level of 101.21. The pair is expected to find its first resistance at 102.50, and a rise through could take it to the next resistance level of 102.78.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.