For the 24 hours to 23:00 GMT, the USD weakened 0.24% against the JPY and closed at 123.57.

In the Asian session, at GMT0300, the pair is trading at 123.29, with the USD trading 0.23% lower from yesterday’s close.

Early morning data showed that Japan’s national consumer prices climbed more than expected by 0.5% YoY in May, compared to prior month’s 0.6% rise. Markets were expecting it to rise 0.4%. Meanwhile, household spending in the nation rebounded 4.8% on an annual basis in May, following a 1.3% drop in April and surpassing market forecasts for an increase of 3.6%.

Other economic data indicated that unemployment rate in Japan remained unchanged at 3.3% in May, at par with market expectations.

Going ahead, investors would keenly await Japan’s industrial production data, slated to release on Sunday.

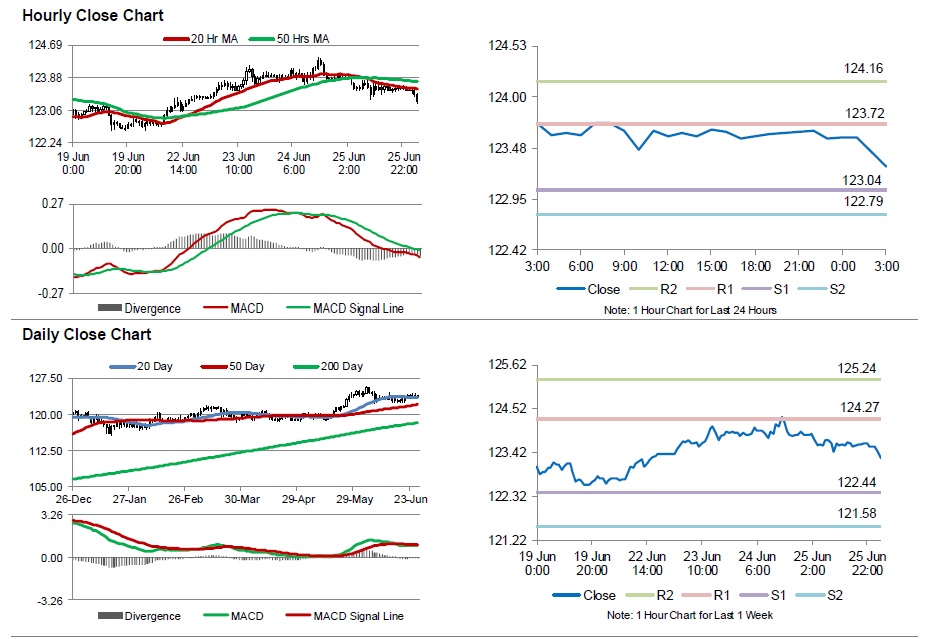

The pair is expected to find support at 123.04, and a fall through could take it to the next support level of 122.79. The pair is expected to find its first resistance at 123.72, and a rise through could take it to the next resistance level of 124.16.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.