For the 24 hours to 23:00 GMT, the USD strengthened 0.25% against the JPY and closed at 102.33. The Japanese Yen lost ground against the US Dollar after the Bank of Japan (BoJ), at its February policy meeting, boosted its existing lending plans.

Separately, the BoJ Governor, Haruhiko Kuroda, reiterated his earlier stance that the central bank would not hesitate to adjust its monetary policy if risk materialises in the economy. However, at the same time, he also opined that the Japanese economy was on track to achieve its inflation target and that the BoJ saw no imminent need for an expansion in its stimulus measures in the immediate future.

In the Asian session, at GMT0400, the pair is trading at 102.25, with the USD trading 0.07% lower from yesterday’s close. Earlier today, in Japan, the all industry activity index declined 0.1% (MoM) in December, following a 0.3% rise recorded in the previous month. Separately, the BoJ in its latest monthly economic survey stated that Japan’s economy has continued to recover moderately, largely due to a pickup in exports, business fixed investments and improvement in corporate profits along with a rise in domestic demand. Another report indicated that final leading economic index in Japan rose to a level of 111.7 in December, from a revised level of 111.3 in the previous month. Meanwhile, the coincident index rose to a level of 111.7 in December, compared to a level of 110.7 recorded in the previous month.

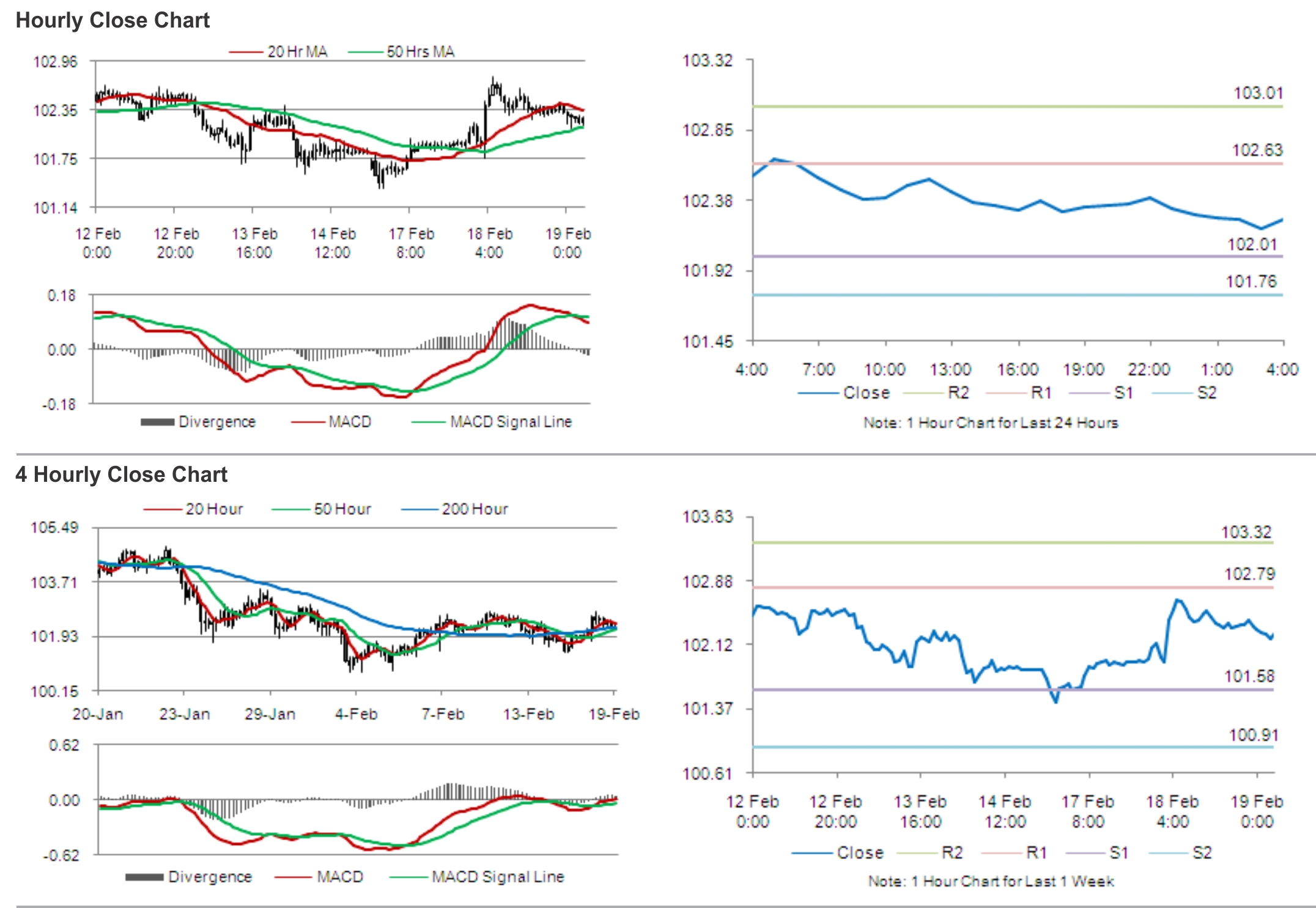

The pair is expected to find support at 102.01, and a fall through could take it to the next support level of 101.76. The pair is expected to find its first resistance at 102.63, and a rise through could take it to the next resistance level of 103.01.

Traders are expected to keep a tab on Japan’s leading economic and coincident index data, scheduled to release later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.