On Friday, the USD weakened 0.18% against the JPY and closed at 102.22, in a thin Japanese holiday trading session.

In Japan, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda stated that the central bank would continue with its massive monetary easing programme as the economy has reached only half the way in its target to achieve 2% inflation target. Furthermore, he indicated that it would be premature to discuss the BoJ’s exit from its stimulus measures even as it has number of tools to do so.

Meanwhile, the IMF indicated in a research report that a wage hike, mainly among smaller businesses and non regular workers would contribute in a big way to Japan’s economic growth. Furthermore, the report noted that higher inflation without higher incomes could not really be called as a formula to a successful reform in the nation.

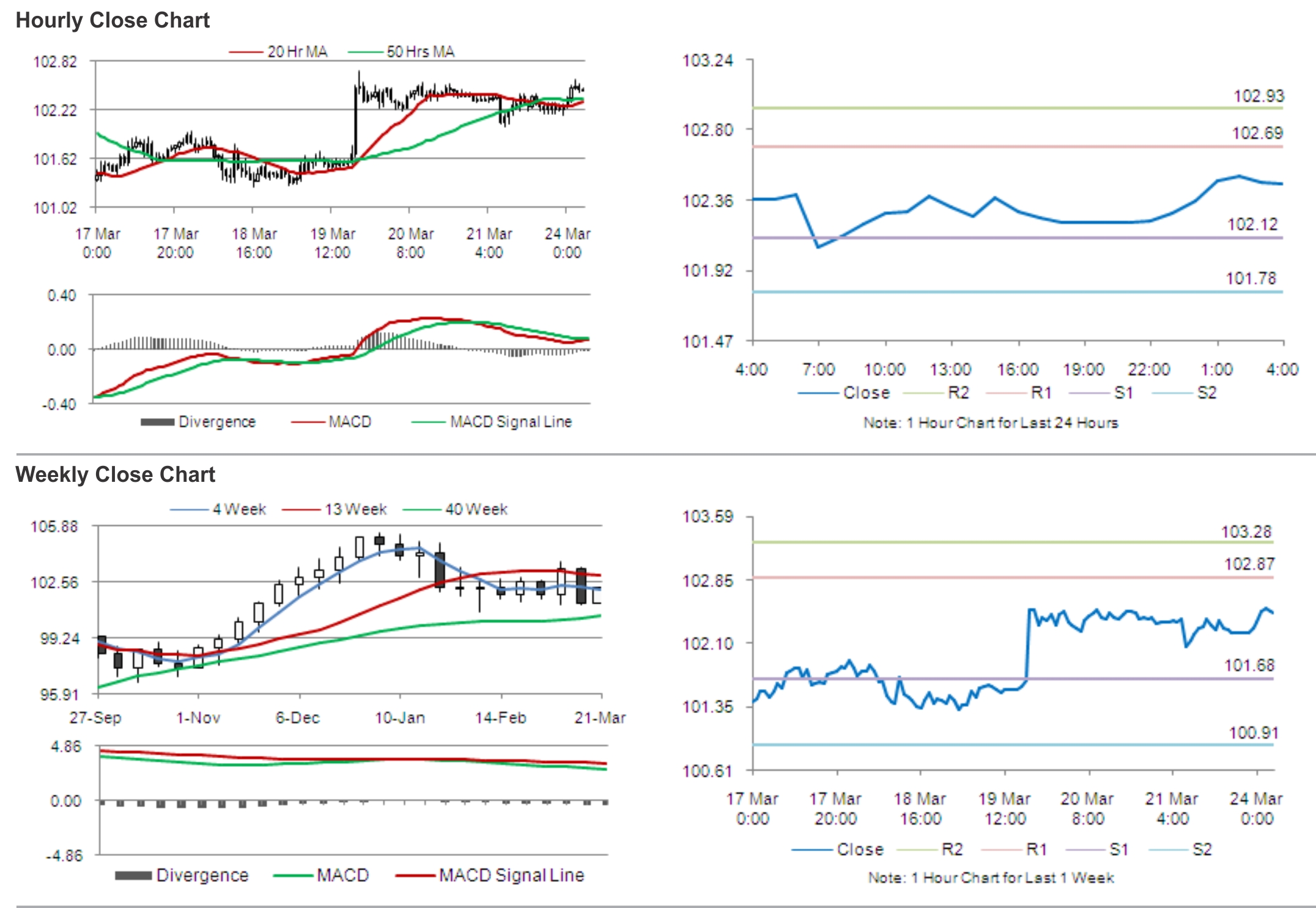

In the Asian session, at GMT0400, the pair is trading at 102.46, with the USD trading 0.24% higher from Friday’s close.

The pair is expected to find support at 102.12, and a fall through could take it to the next support level of 101.78. The pair is expected to find its first resistance at 102.69, and a rise through could take it to the next resistance level of 102.93.

Market participants wait the BoJ Deputy Governor, Hiroshi Nakaso’s speech, expected to commence later today, for further guidance in the Yen.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.