For the 24 hours to 23:00 GMT, the USD marginally rose against the JPY and closed at 110.75.

In economic news, Japan’s flash leading economic index advanced to a level of 106.3 in June, surpassing market expectations of a rise to a level of 106.2. In the prior month, the index had registered a level of 104.6. Further, the nation’s flash coincident index recorded a rise to a level of 117.2 in June, meeting market consensus and after recording a level of 115.8 in the prior month.

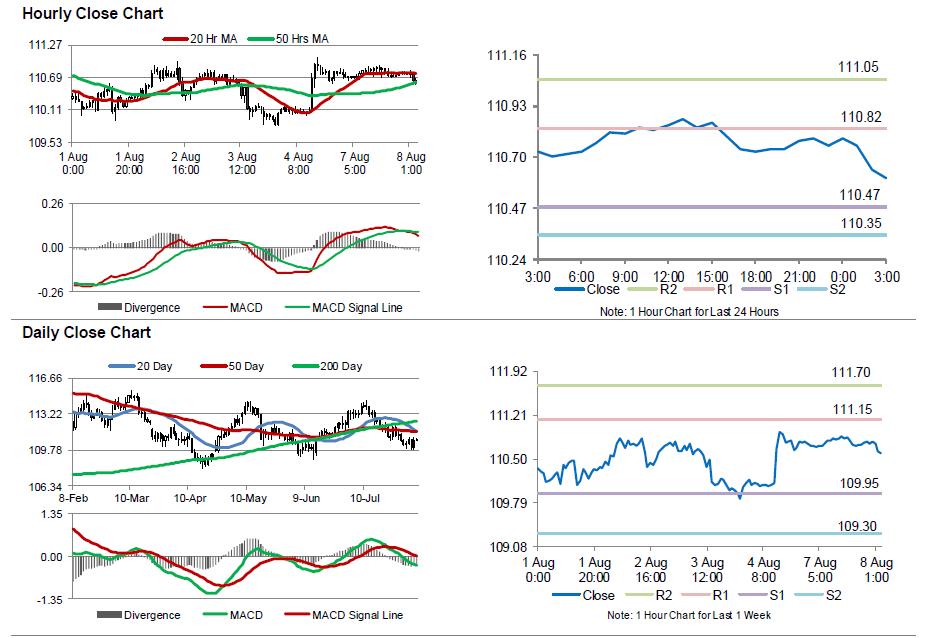

In the Asian session, at GMT0300, the pair is trading at 110.6, with the USD trading 0.14% lower against the JPY from yesterday’s close.

Overnight data indicated that Japan registered a (BOP basis) trade surplus of ¥518.5 billion in June, following a deficit of ¥115.1 billion in the prior month, while markets were expecting the nation to post a surplus of ¥571.5 billion.

The pair is expected to find support at 110.47, and a fall through could take it to the next support level of 110.35. The pair is expected to find its first resistance at 110.82, and a rise through could take it to the next resistance level of 111.05.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.