For the 24 hours to 23:00 GMT, the USD declined 0.18% against the JPY and closed at 111.51 on Friday.

In the Asian session, at GMT0400, the pair is trading at 111.56, with the USD trading slightly higher against the JPY from Friday’s close.

Overnight data showed that Japan posted a merchandise (total) trade surplus of ¥339.0 billion in February, compared to a deficit of ¥1415.6 billion in the preceding month. Market participants had envisaged the nation to record a surplus of ¥305.1 billion.

Moreover, early morning data indicated that the nation’s final industrial production climbed 0.3% on an annual basis in January, while preliminary figures had indicated a flat reading. In the previous month, industrial production had registered a drop of 1.90%.

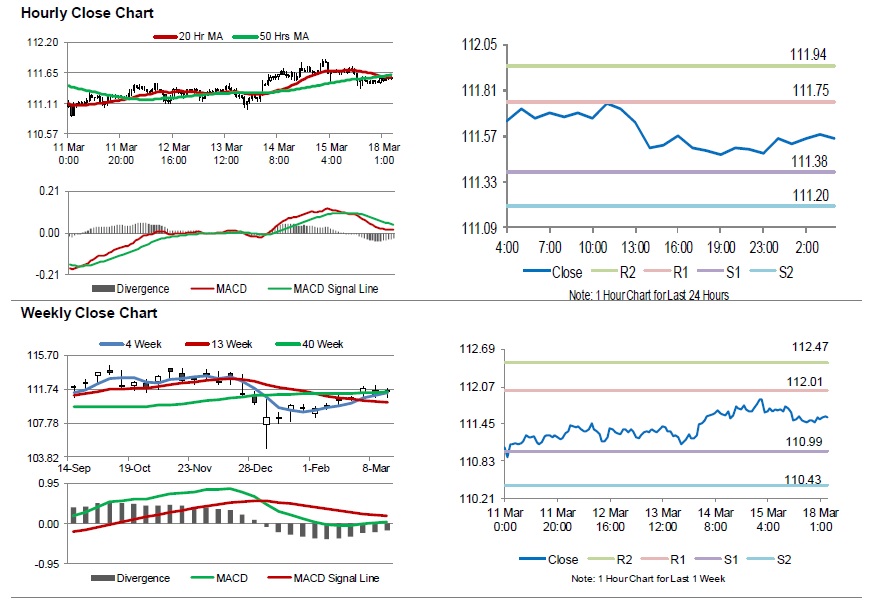

The pair is expected to find support at 111.38, and a fall through could take it to the next support level of 111.20. The pair is expected to find its first resistance at 111.75, and a rise through could take it to the next resistance level of 111.94.

With no macroeconomic releases in Japan today, investors would look forward to global macroeconomic releases for further directions.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.