For the 24 hours to 23:00 GMT, the USD rose 0.05% against the JPY and closed at 113.51.

In the Asian session, at GMT0400, the pair is trading at 113.69, with the USD trading 0.16% higher against the JPY from yesterday’s close.

Overnight data revealed that Japan posted a trade surplus (BOP basis) ¥323.3 billion in September, less than market expectations for a surplus of ¥334.2 billion. In the previous month, the nation had recorded a deficit of ¥219.3 billion. Moreover, Japan’s machinery orders unexpectedly dropped 7.0% on an annual basis in September, defying market expectations for a rise of 7.7%. In the previous month, machinery orders had registered a gain of 12.6%.

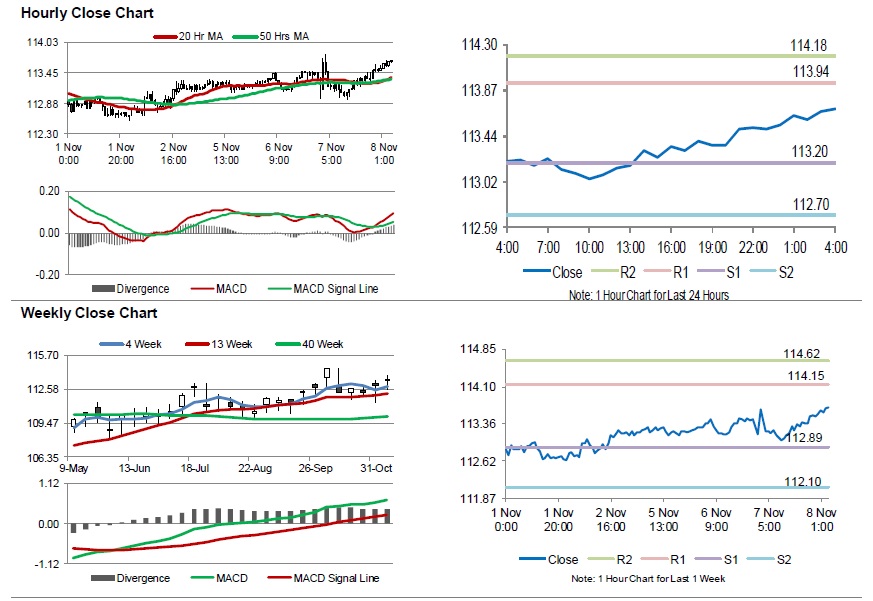

The pair is expected to find support at 113.20, and a fall through could take it to the next support level of 112.70. The pair is expected to find its first resistance at 113.94, and a rise through could take it to the next resistance level of 114.18.

Amid lack of economic releases in Japan today, traders would focus on global macroeconomic events for further direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.