On Friday, the USD strengthened 0.31% against the JPY and closed at 102.64, benefited from the comments of the St. Louis Fed Chief, James Bullard, that the Fed would continue tapering its massive accommodative stimulus measure as the US economy is headed for a good year of growth.

Meanwhile, in Japan, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda, indicated that the economy has reached only half-way on its path to achieve 2% inflation target and that it would be too early to discuss an exit strategy for the central bank’s ultra-easy stimulus measure.

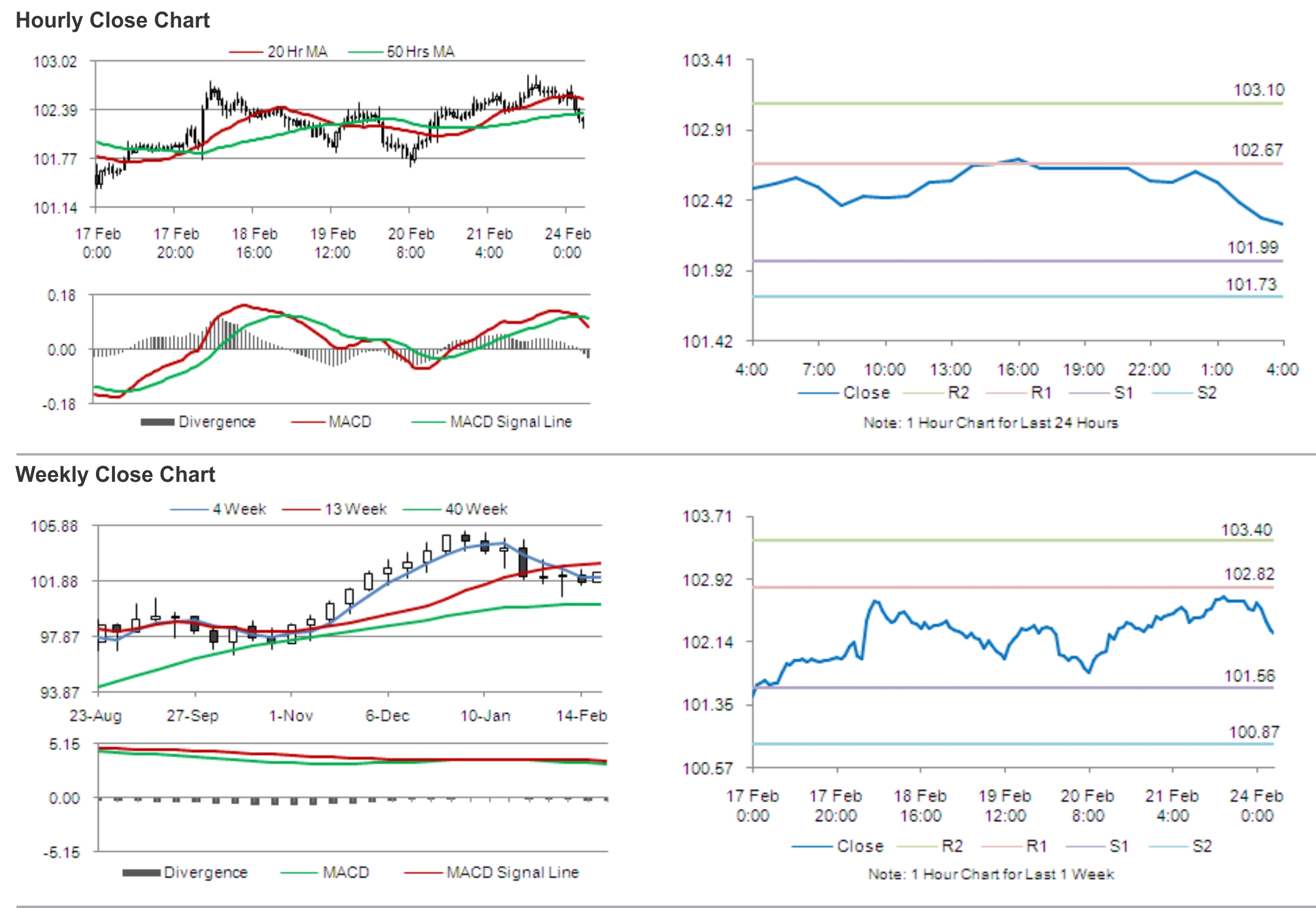

In the Asian session, at GMT0400, the pair is trading at 102.25, with the USD trading 0.38% lower from Friday’s close.

The pair is expected to find support at 101.99, and a fall through could take it to the next support level of 101.73. The pair is expected to find its first resistance at 102.67, and a rise through could take it to the next resistance level of 103.10.

During the later course of the day, the BoJ is expected to publish a report on Japan’s corporate service price.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.