For the 24 hours to 23:00 GMT, the USD weakened 0.12% against the JPY and closed at 104.21.

In the Asian session, at GMT0300, the pair is trading at 104.62, with the USD trading 0.39% higher against the JPY from Friday’s close.

Overnight data showed that, Japan total merchandise trade balance swung to a deficit of ¥40.7 billion in May, compared to a revised trade surplus of ¥823.5 billion in the prior month, as Japan’s exports fell at the fastest pace since January. Markets were anticipating the nation to register a trade surplus of ¥70.0 billion. The nation’s exports fell more-than-expected by 11.3%, dropping for the eighth consecutive month while imports fell in line with market expectations by 13.8%, on an annual basis in May.

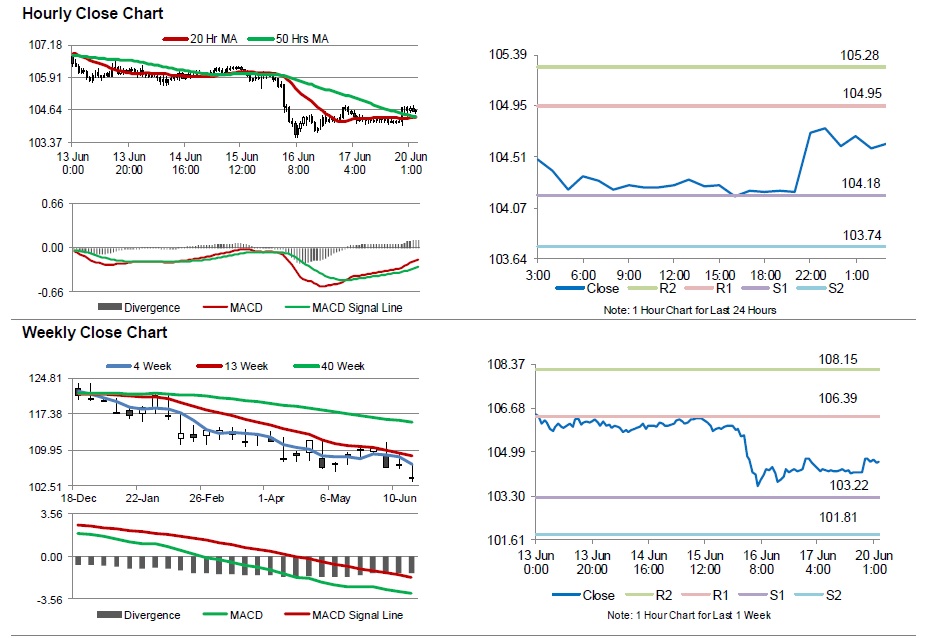

The pair is expected to find support at 104.18, and a fall through could take it to the next support level of 103.74. The pair is expected to find its first resistance at 104.95, and a rise through could take it to the next resistance level of 105.28.

Going ahead, market participants will look forward to the Bank of Japan’s monetary policy meeting minutes, scheduled to release tonight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.