For the 24 hours to 23:00 GMT, the USD rose 0.76% against the JPY and closed at 113.09.

In the Asian session, at GMT0400, the pair is trading at 113.29, with the USD trading 0.18% higher against the JPY from yesterday’s close.

Overnight data revealed that Japan’s final gross domestic product (GDP) rose 0.6% on a quarterly basis in the three months to September, revised up from a preliminary print indicating an advance of 0.3%. The nation’s GDP had registered a similar rise in the previous quarter.

Meanwhile, the nation’s trade surplus (BOP basis) narrowed less-than-expected to ¥430.2 billion in October, from a surplus of ¥852.2 billion in the previous month, while market participants had envisaged the nation to register surplus of ¥418.1 billion.

Earlier in the session, data indicated that the nation’s Eco-Watchers Survey for the current situation registered an unexpected rise to a level of 55.1 in November, against market expectations for a decline to a level of 52.1. The index had recorded a level of 52.2 in the prior month. On the contrary, the nation’s Eco Watchers Survey for the future outlook fell to a level of 53.8 in November, more than market consensus for a drop to a level of 54.0 and after recording a reading of 54.9 in the prior month.

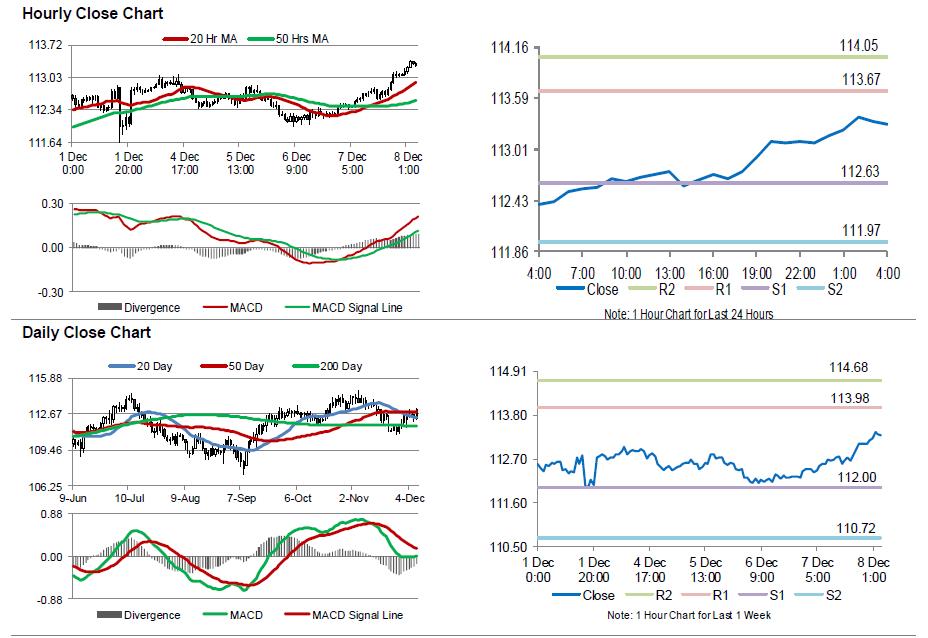

The pair is expected to find support at 112.63, and a fall through could take it to the next support level of 111.97. The pair is expected to find its first resistance at 113.67, and a rise through could take it to the next resistance level of 114.05.

Going ahead, investors would look forward to Japan’s flash Nikkei manufacturing PMI, Tankan large manufacturing and non-manufacturing indices, all due to release next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.