For the 24 hours to 23:00 GMT, the USD rose marginally against the JPY and closed at 106.75 on Friday.

In the Asian session, at GMT0400, the pair is trading at 107.40, with the USD trading 0.61% higher against the USD from Friday’s close.

Overnight data revealed that, Japan’s flash annualised gross domestic product (GDP) rose 2.2% on a quarterly basis in 3Q 2016, expanding for the third straight quarter, suggesting the economy has regained some momentum. The GDP rose by 0.7% in the previous quarter while surpassing market expectation for an expansion of 0.8%. Additionally, the nation’s final industrial production climbed by 0.6% on a monthly basis in September, advancing for a second straight month, following a rise of 1.3% in the prior month. The preliminary figures had indicated a flat reading.

Meanwhile, the Bank of Japan Governor, Haruhiko Kuroda, reiterated that Japanese economy is likely to expand moderately and is heading towards the central bank’s 2.0% inflation target but risks are tilted to the downside due to uncertainty over the global economy.

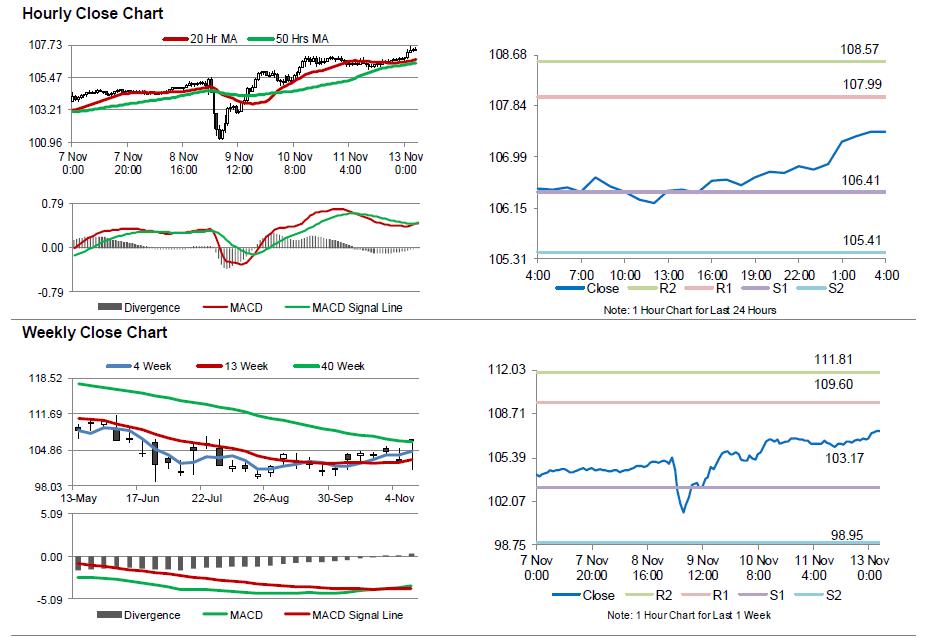

The pair is expected to find support at 106.41, and a fall through could take it to the next support level of 105.41. The pair is expected to find its first resistance at 107.99, and a rise through could take it to the next resistance level of 108.57.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.