For the 24 hours to 23:00 GMT, the USD strengthened 0.34% against the JPY and closed at 102.18 on the back of a strong US consumer inflation data.

In the Asian session, at GMT0300, the pair is trading at 102.16, with the USD trading slightly lower from yesterday’s close.

Earlier today, minutes from the BoJ’s 20-21 May 2014 policy meeting, revealed policymakers’ view for the Japanese economy to continue with its moderate pace of recovery in the near further. The minutes also highlighted the central bank’s concerns on the recovery prospects of the nation’s export sector, which according to some officials might be hit due to a political crisis in Thailand. Separately, an official report showed that, the total merchandise trade deficit in Japan widened to ¥909.0 billion in May, compared to the prior month’s deficit of ¥808.9 billion, as imports unexpectedly fell last month.

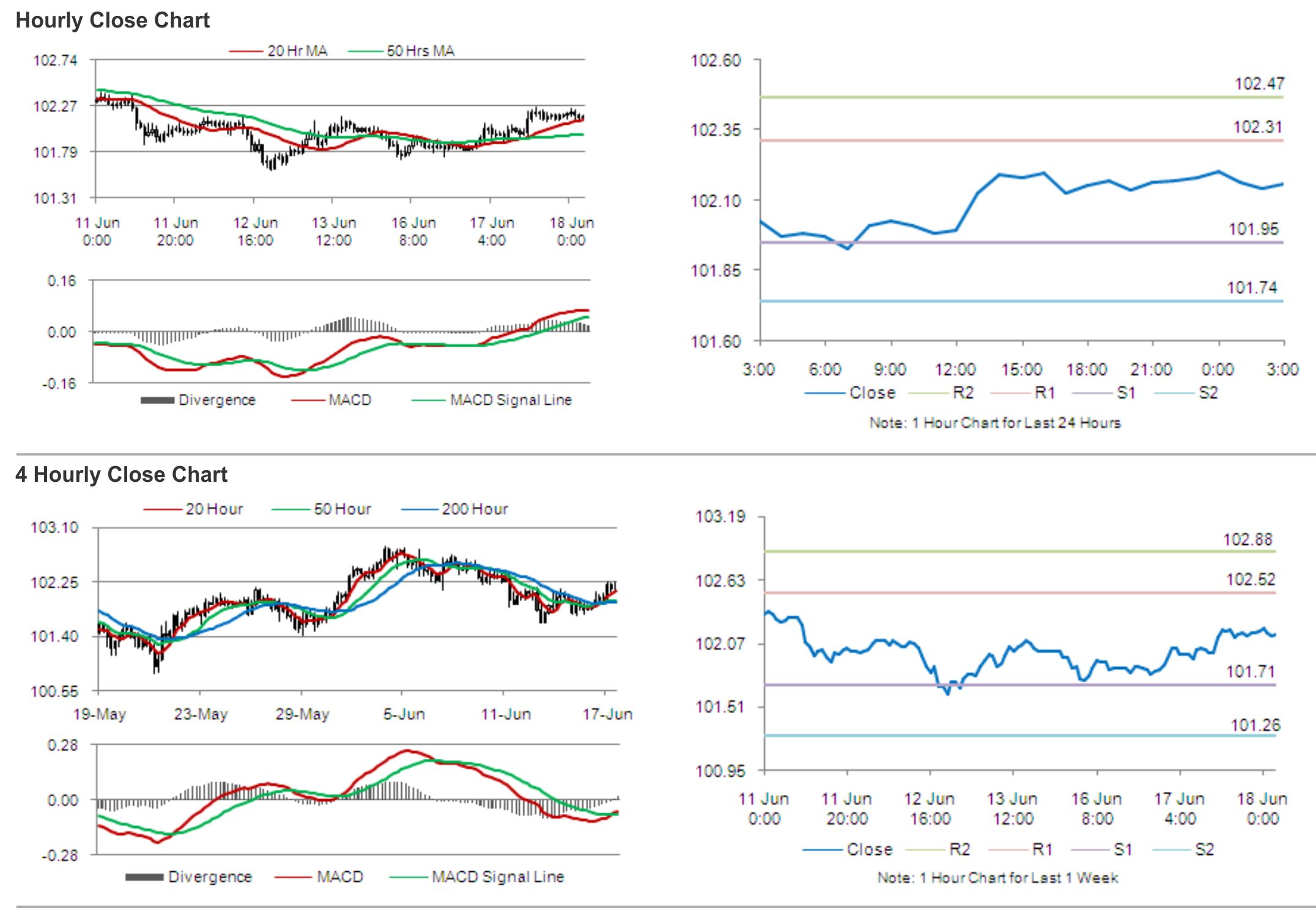

The pair is expected to find support at 101.95, and a fall through could take it to the next support level of 101.74. The pair is expected to find its first resistance at 102.31, and a rise through could take it to the next resistance level of 102.47.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.