For the 24 hours to 23:00 GMT, the USD strengthened 0.25% against the JPY and closed at 108.11. The Japanese currency lost ground after Japan’s small business confidence unexpectedly fell to a level of 47.4 in October, following previous month’s reading of 47.6, while markets were expecting it to rise to 48.5.

In the Asian session, at GMT0400, the pair is trading at 108.16, with the USD trading a tad higher from yesterday’s close.

Earlier today, in Japan, industrial production rose 2.7% on a monthly basis in September, registering its fastest pace of expansion since January, beating market expectations for a 2.2% increase and compared to a drop of 1.9% registered in August.

This morning, leading ratings agency, Standard & Poor’s cautioned that the second phase of Japan’s planned sales tax hike in 2015 would lead to a further downgrade of the nation’s credit rating, if the move decelerates the pace of expansion in the economy.

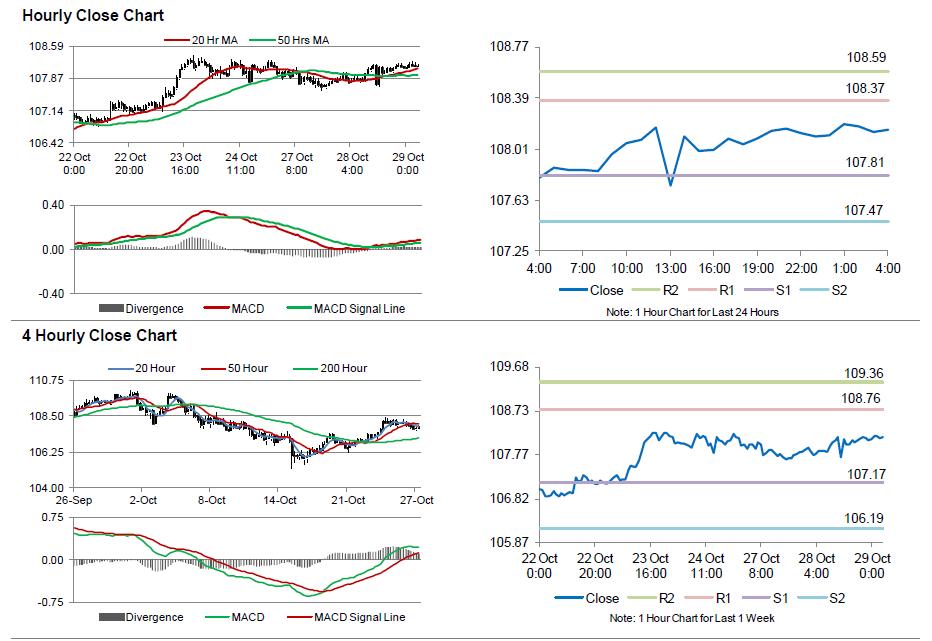

The pair is expected to find support at 107.81, and a fall through could take it to the next support level of 107.47. The pair is expected to find its first resistance at 108.37, and a rise through could take it to the next resistance level of 108.59.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.