For the 24 hours to 23:00 GMT, the USD strengthened 0.25% against the JPY and closed at 102.10 following upbeat US consumer confidence data.

In the Asian session, at GMT0300, the pair is trading at 102.10, with the USD trading flat from yesterday’s close.

In the economic news, Japan’s industrial production shrank 3.3%, on a monthly basis in June, after witnessing a 0.7% rise in the previous month. Meanwhile, the small business confidence index in Japan rose to a level of 48.7 in July, compared to a reading of 47.3 in the prior month.

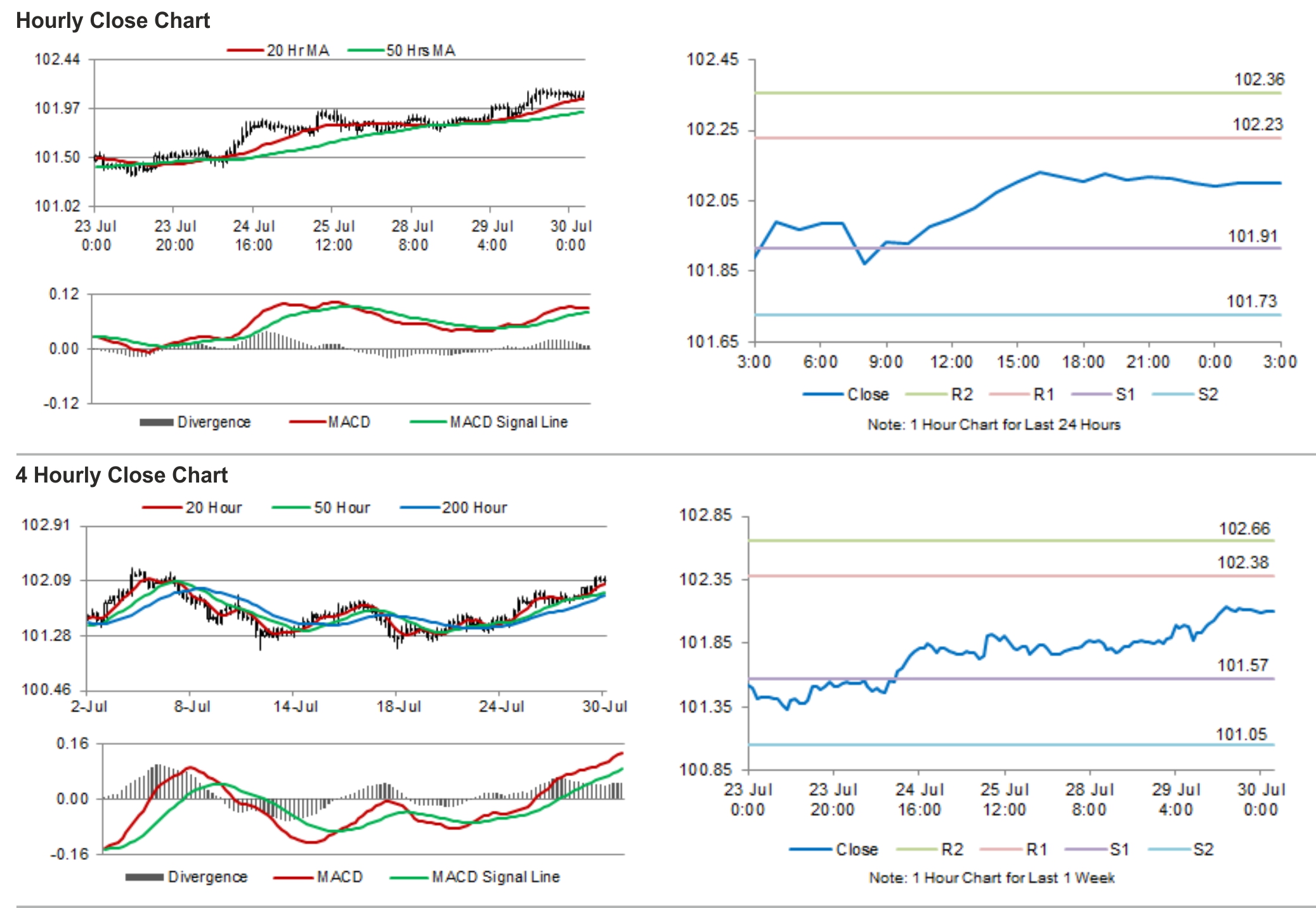

The pair is expected to find support at 101.91, and a fall through could take it to the next support level of 101.73. The pair is expected to find its first resistance at 102.23, and a rise through could take it to the next resistance level of 102.36.

Amid a lack of economic releases from Japan today, investors would shift their attention to the release of Japanese housing starts data, to be out tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.